jilergonomics.ru Tools

Tools

Best Bank To Apply For Personal Loan

%% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. Apply for a personal loan online with FIRSTmoney and get application process, ensuring swift disbursal of loan amounts directly to your bank account. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Their loans range from $5, to $,, with two to seven-year repayment terms. Interest rates range from % to % after applying discounts. SoFi is. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. Apply for a personal loan online with FIRSTmoney and get application process, ensuring swift disbursal of loan amounts directly to your bank account. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Their loans range from $5, to $,, with two to seven-year repayment terms. Interest rates range from % to % after applying discounts. SoFi is. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade.

Summary of Top Lenders · SoFi · LightStream · PenFed Credit Union · Avant · Prosper. Best for home improvement: LightStream. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. The best personal loan company overall is LightStream, as this online personal loan provider offers an excellent combination of low interest rates, $0 fees, and. SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for poor credit. · Prosper: Best peer-to-peer lender. · Axos Bank: Best for excellent. Get low-interest personal loans quickly with Best Egg. Apply online in minutes & receive funds fast. Start your journey to financial stability now! With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today! PenFed was the only credit union that made our list. Its personal loan rates are some of the lowest on the market, and highly qualified borrowers can receive a. From there, a lending specialist will help you determine what loan and terms work best for your circumstances and assist you with the personal loan application. At Eastern Bank, we do good things to help people prosper See how a personal loan from Eastern Bank can help you achieve your financial goals! Apply online. Personal loans often have lower interest rates if you have good credit. Also, you don't have to be a U.S. Bank customer to apply for a personal loan. A personal. Best Overall: U.S. Bank · Best for Debt Consolidation: Discover · Best for Fast Funding: Citibank · Best for American Express Cardholders: American Express. Best Banks for Personal Loans ; U.S. Bank, Overall, $1, to $50, ; Discover, Debt consolidation, $2, to $40, ; Citibank, Fast funding, $2, to $30, See how we compare. Filter Products. Citibank Best Egg Lending Club Santander Learn how she applies to get a Santander Personal Loan quickly and easily. When beginning your search for a personal loan, be sure to start with your current bank — it may have exclusive perks for existing customers. Other banks to. Well-qualified candidates can get a quick decision when you apply for a personal loan Best Credit Unions for Personal Loans. GoBankingRates. Our simple online application and digital banking* options make it easy to manage your personal loan. Member Benefits. Navy Federal members receive exclusive. Truist offers fixed rate unsecured personal loans starting at $ Apply now to consolidate debt, pay for home improvements, or manage big expenses. Well-qualified candidates can get a quick decision when you apply for a personal loan Best Credit Unions for Personal Loans. GoBankingRates. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now!

Wag Prices

We are committed to providing top quality grooming services to our customers. WAG-A-LOT offers a full range of grooming services and are able to handle all. Pet Perks. More wiggle in the wag! wagbnb offers lots of ways to pamper your pet and add even more quality to their stay. From pupsicles to bedtime stories. All daycare prices include taxes & fees. Holidays incur $10 surcharge per day. Fully insured and bonded; Available days a year from 7am-9pm; Convenient scheduling and cancellations; Online bill pay; Prices do not increase for night. The monthly Wag! Premium subscription costs $ per month or $ per year. *additional charges may apply. How do I sign up for. cost. *Additional fees apply for add-ons. Please contact us for pricing. We understand that not all weddings are the same. Contact us and we are happy to. Pricing listed is the rack rate before discounts, taxes and fees (if any) apply. Monthly Packs are valid for 30 consecutive days and expire 30 days after. Check out this page to find out more information about our services and pricing at Wag'n Paddle. See if a membership is right for you!! Wag'n World · Dog daycare and boarding packages NEVER EXPIRE! · All pricing and policies are subject to change without notice. · Boarding package owners subject. We are committed to providing top quality grooming services to our customers. WAG-A-LOT offers a full range of grooming services and are able to handle all. Pet Perks. More wiggle in the wag! wagbnb offers lots of ways to pamper your pet and add even more quality to their stay. From pupsicles to bedtime stories. All daycare prices include taxes & fees. Holidays incur $10 surcharge per day. Fully insured and bonded; Available days a year from 7am-9pm; Convenient scheduling and cancellations; Online bill pay; Prices do not increase for night. The monthly Wag! Premium subscription costs $ per month or $ per year. *additional charges may apply. How do I sign up for. cost. *Additional fees apply for add-ons. Please contact us for pricing. We understand that not all weddings are the same. Contact us and we are happy to. Pricing listed is the rack rate before discounts, taxes and fees (if any) apply. Monthly Packs are valid for 30 consecutive days and expire 30 days after. Check out this page to find out more information about our services and pricing at Wag'n Paddle. See if a membership is right for you!! Wag'n World · Dog daycare and boarding packages NEVER EXPIRE! · All pricing and policies are subject to change without notice. · Boarding package owners subject.

For all listed prices, additional charges may apply. *Or hamster, frog, fish, bird, bunny, hedgehog, salamander or any other domestic pets – even plants. NYC Doggy Daycare, Boarding, Grooming, and Dog Walks. Easy Wag was created with your dog in mind. We make sure our products are all natural and made in New. CoolWag is a dog's dream come true. With all hotel stays, your pup will have All prices are subject to sales tax. Includes group play or other. To Wag For - Bel Air, Bel Air, Maryland. likes · 37 talking about this · were here. To Wag For gives your pet something to wag for! Follow us. Get the Best Price and Selection of Grooming Dog Products at Pet Supplies Plus. Wag N' Wash Natural Pet Food and Grooming began as a dog grooming and. Wag sets the price, not the sitter. The dog owner announces he needs a dog Therefore, dog walks, boarding, sitting, and daycare all have fixed prices. Bathing Rates Start at $60+ and Grooming Rates Start at $75+. We can groom the entire cat or we can trim nails, clean ears. WAG 4 TAILS - DOG WALKING - affordable and professional local dog walkers, insured and bonded. We offer daily dog walking visits and vacation pet care as. " That's why Wag N' Wash offers full-service, professional grooming at every location. Even if you do enjoy bathing your pup, everyone deserves a spa day. The average cost of a dog walk in New York is $ The price of a dog walk on the Wag! platform is based on the price set by the Pet Caregiver and varies. If you're in a large city and like dogs, I think it's at least worth trying out to see if it's for you. At most, it'll cost you $25 and a little bit of time. If. Dogs 50–90 lbs.: spay or neuter, $, $ ; Dogs 50–90 lbs.: spay or neuter package –*Booster Vaccine fees are not included in packages, they are an additional. Tender Loving Day Care and Boarding for Dogs in metro Denver · DAYCARE RATES. FULL DAY: $40 (15% OFF for 2nd dog, same family - add $) HALF DAY (4 hours or. Western Wag is a Family Owned Pet Care Service in Wicker Park offering Doggy Daycare, Boarding, and Walks. SERVICES & RATES · THE INITIAL CONSULT (NO CHARGE) · DOG WALKING FOR UP TO 2 DOGS · Minute walk · $23 · MINute WALK · $27 · minute walk. Pricing Information. DAYCARE. Allow your dog to run, sniff, and play all day at Wag 'n Woofs! Overnight care includes playing with friends all day, which. At Wag Mates Academy, we take a holistic approach to your dog's development, from consultation to tailored programs, convenient pick-up, and engaging 'Board. Wag! is the #1 app for Pet Parents -- offering 5-star dog walking, pet sitting, vet care, and training services nationwide. Book convenient pet care in your. Wag Resort in Grand Junction, CO is the area's premier Pet Resort with 2 locations! We provide luxury dog boarding, safe and fun dog daycare.

Europacific Growth Fund R2

Complete American Funds EuroPacific Growth Fund;R2 funds overview by Barron's. View the RERBX funds market news. Higher Return 3 year annual total return Lower Return American Funds Europacific Growth R2 Other funds in category 10 15 20 25 30 35 -5 0 5 The Fund seeks to provide long-term growth of capital. The Fund will invest its net assets in securities of issuers in Europe and the Pacific Basin. It will be. WT EuroPacific Growth Trust (American Funds). This fund is managed by a team Class R2. International Growth Fund II (MFS), Class I1 · Class I2 · Class R1. John Hancock Funds International Growth Fund Class. R2 (03/15). JHIGX. -. American Funds EuroPacific Growth Fund® Class F-1 ( American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R2 (RERBX). Type. Open-end mutual fund. Manager. American Funds/Capital. American Funds Europacific Growth R2 (RERBX) is an actively managed International Equity Foreign Large Growth fund. American Funds launched the fund in American Funds EuroPacific Growth Fund;R2 advanced mutual fund charts by MarketWatch. View RERBX mutual fund data and compare to other funds. The fund invests primarily in common stocks of in Europe and the Pacific Basin that the investment adviser believes have the potential for growth. Growth stocks. Complete American Funds EuroPacific Growth Fund;R2 funds overview by Barron's. View the RERBX funds market news. Higher Return 3 year annual total return Lower Return American Funds Europacific Growth R2 Other funds in category 10 15 20 25 30 35 -5 0 5 The Fund seeks to provide long-term growth of capital. The Fund will invest its net assets in securities of issuers in Europe and the Pacific Basin. It will be. WT EuroPacific Growth Trust (American Funds). This fund is managed by a team Class R2. International Growth Fund II (MFS), Class I1 · Class I2 · Class R1. John Hancock Funds International Growth Fund Class. R2 (03/15). JHIGX. -. American Funds EuroPacific Growth Fund® Class F-1 ( American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R2 (RERBX). Type. Open-end mutual fund. Manager. American Funds/Capital. American Funds Europacific Growth R2 (RERBX) is an actively managed International Equity Foreign Large Growth fund. American Funds launched the fund in American Funds EuroPacific Growth Fund;R2 advanced mutual fund charts by MarketWatch. View RERBX mutual fund data and compare to other funds. The fund invests primarily in common stocks of in Europe and the Pacific Basin that the investment adviser believes have the potential for growth. Growth stocks.

Higher Return 3 year annual total return Lower Return American Funds Europacific Growth R2 Other funds in category 10 15 20 25 30 35 -5 0 5 Your Mutual Fund. American Funds EuroPacific Gr R2 (RERBX) Expense Ratio: % Expected Lifetime Fees: $45, The American Funds EuroPacific Gr R2 fund. R2. R3. Classic. Fibonacci. EuroPacific Growth Fund - Class R2E's (REEBX) Day exponential moving. Growth I Invesco Oppenheimer International Gr R6 American Funds Europacific Growth R6. MSCI ACWI Ex USA NR USD. Page 7. For investment professionals and. The investment seeks long-term growth of capital. The fund invests primarily in common stocks of in Europe and the Pacific Basin that the investment adviser. Balanced Portfolio – AB Large. Cap Growth Z. APGZX. Large Growth. 10%. Ultra-Aggressive Portfolio – American Funds. EuroPacific Growth R3. %. Ultra-. American Funds EuroPacific Growth R2. %. $7, %. $ American American Funds Growth Fund of America R2. %. $64, %. $ American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R2 (RERBX). Type. Open-end mutual fund. Manager. American Funds/Capital. Investment portfolio. Financial statements. EuroPacific Growth Fund - Page 1. Certain investment limitations and guidelines R2' (superior), 'R3' (good) or. AMERICAN FD EUROPACIFIC GROWTH FUND R2 (RERBX) View Prospectus, 1, $, $, $, $ AMERICAN FD EUROPACIFIC GROWTH FUND R3 (RERCX) View Prospectus, 1. Check out American Funds Europacific Growth R2 via our interactive chart to view the latest changes in value and identify key financial events to make the. American Funds Europacific Growth R2 (RERBX). Type. Open-end mutual fund. Manager. American Funds/Capital Group. Gender equality score. Find our live American Funds Europacific Growth Fund® Class R-2 fund basic information. View & analyze the RERBX fund chart by total assets, risk rating. R2 (RERBX). Fund. RERGX. Price as of: AUG 06, PM EDT. $ + $ + EUROPACIFIC GROWTH FUND. RERGX | Fund. $ $ B. %. $ %. American Funds - EuroPacific Growth Fund Class R-1 Shares, $ R2, RERBX, American Funds - EuroPacific Growth Fund Class R-2 Shares, $ R3, RERCX. American Funds EuroPacific Growth Fund® RERBX has $ BILLION invested in fossil fuels, 11% of the fund. American Funds Europacific Growth - R3 · American Funds Europacific Growth F3 · American Funds Europacific Growth R2 · American Funds Europacific Growth R2. American Funds EuroPacific Growth R5. RERFX. PGIM TOTAL RETURN BOND R6. PTRQX. ClearBridge Mid Cap Core Fund Class IS. LSIRX. CREF Stock R2. QCSTPX. CREF Social. Chart for American Funds - Europacific Growth Fund Class R-2 Shares RERBX. RERBX American Funds EuroPacific Gr R2 Fund Class Information. Class Name, Ticker. Foreign Large Growth; RERBX. RERBX. American Funds Europacific Growth-R2. $ (%). Currency in USD / Last Updated: 7/9/ Category, Foreign-.

Reviews For Robinhood

:max_bytes(150000):strip_icc()/robinhood-productcard-5c743379c9e77c00010d6c5e.png)

Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood Brokerage Account Community Reviews Would you recommend Robinhood Brokerage Account to your friends? This product is strongly recommended by. Robinhood. Overview Reviews About. Robinhood Reviews. 3, • Bad. In the Restaurants & Bars category. jilergonomics.ru Visit this website · jilergonomics.ru · Write. Robinhood is easily one of the best options in the United States for online trading and investments. This popular broker is a good option for anyone interested. Robinhood is an exceptional trading platform that lets users trade without paying the traditional commission fees. With its intuitive features, the app benefits. Esposito. 🗓️. Updated: August 06, Listen. Robin hood statue in nottingham. Robinhood review: Is Robinhood safe and worth using? Ink Drop / Shutterstock. If you're seeking a full-service investment brokerage platform with access to bonds, mutual funds and futures trading, Robinhood isn't for you. That said, it. Overview. Robinhood has a rating of stars from reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers. I have used several financial services companies. Robinhood is the worst. No customer service, hidden fees, and they will stall as long as they can when. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood Brokerage Account Community Reviews Would you recommend Robinhood Brokerage Account to your friends? This product is strongly recommended by. Robinhood. Overview Reviews About. Robinhood Reviews. 3, • Bad. In the Restaurants & Bars category. jilergonomics.ru Visit this website · jilergonomics.ru · Write. Robinhood is easily one of the best options in the United States for online trading and investments. This popular broker is a good option for anyone interested. Robinhood is an exceptional trading platform that lets users trade without paying the traditional commission fees. With its intuitive features, the app benefits. Esposito. 🗓️. Updated: August 06, Listen. Robin hood statue in nottingham. Robinhood review: Is Robinhood safe and worth using? Ink Drop / Shutterstock. If you're seeking a full-service investment brokerage platform with access to bonds, mutual funds and futures trading, Robinhood isn't for you. That said, it. Overview. Robinhood has a rating of stars from reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers. I have used several financial services companies. Robinhood is the worst. No customer service, hidden fees, and they will stall as long as they can when.

Robinhood has a rating of stars from reviews, indicating that most customers are generally dissatisfied with their purchases. Robinhood has a rating of out of five stars based on over reviews on the Better Business Bureau (BBB) and is not BBB accredited. Over 2, complaints. Robinhood is easily one of the best options in the United States for online trading and investments. This popular broker is a good option for anyone interested. Final Thoughts – Robinhood Review Overall, Robinhood has improved its service by quite a bit but it still doesn't make up for some of its shortcomings that. Is Robinhood safe? Robinhood is a trustworthy company offering a platform where trained and untrained people can do their own investing and reap the benefits. In our Robinhood Crypto review, we learned that trading crypto coins is as easy as trading stocks on the stock investment platform. Robinhood Crypto lacks a. Robinhood Brokerage Account Community Reviews Would you recommend Robinhood Brokerage Account to your friends? This product is strongly recommended by. Robinhood is a go-to platform for many active traders, given it doesn't charge commission fees on trades and offers a variety of investment options. More hands-. Robinhood was rated out of 5 based on reviews from actual users. Find helpful reviews and comments, and compare the pros and cons of Robinhood. How are Robinhood reviews? The reception for Robinhood by those who use the app seem to be pretty favorable. It holds a out of 5 stars on 4+ million ratings. Tech-savvy investors who are short on cash are likely to consider investing via Robinhood. The platform's top features include. Ratings and Reviews · As of lately I have literally been logging into my Robinhood app at least 7 times a day or more. I am very familiar with the layout, the. Robinhood is bad for investing. It's only good for very basic needs. If you are planning for transparency and a reliable retirement vehicle. Sadly the new Robin Hood is frankly not that good, an often bizarre and mostly charmless affair that sees Robin of Loxley become some type of Assassin's Creed. 44% of job seekers rate their interview experience at Robinhood as positive. Candidates give an average difficulty score of 3 out of 5 (where 5 is the highest. Robinhood is a great broker if you're looking for cheap, no-nonsense US stock and ETF trading on the go. To put it simply, Robinhood shines as a user-friendly, no-frills platform – and all of these advantages play well together with a mobile app. You won't get much. One of the biggest draws to Robinhood is its simple, clean interface. The platform features beautiful charts and minimal clutter. It also makes trading easy;. Ease of Use: Robinhood is known for its user-friendly interface and low barrier to entry, making it a popular choice for beginners. · Cost. Robinhood has star rating based on customer reviews. Consumers are mostly dissatisfied. · 16% of users would likely recommend Robinhood to a friend or.

How To Measure Square Feet Of A House

All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. To figure the square foot wall coverage simply measure the length of the wall and multiply it by the height of the wall. Each wall should be measured and. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, Divide the space into smaller sections. · Measure each section separately and calculate the square footage of each. · Use a calculator to add the numbers together. To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. All you have to do is bring out your measuring tape and measure its width and length. Multiply the length by the width and there you go! You have the square. A square foot is a unit of measurement measuring 1 foot x 1 foot. If an area is square feet, it means the area can be divided into squares which have. If the parcel is rectangular, length times width equals area. If you measure in feet, your area will be in square feet. Otherwise, you can look. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. To figure the square foot wall coverage simply measure the length of the wall and multiply it by the height of the wall. Each wall should be measured and. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, Divide the space into smaller sections. · Measure each section separately and calculate the square footage of each. · Use a calculator to add the numbers together. To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. All you have to do is bring out your measuring tape and measure its width and length. Multiply the length by the width and there you go! You have the square. A square foot is a unit of measurement measuring 1 foot x 1 foot. If an area is square feet, it means the area can be divided into squares which have. If the parcel is rectangular, length times width equals area. If you measure in feet, your area will be in square feet. Otherwise, you can look.

For Rolled Goods, like Carpet and Sheet Vinyl, measure from edge to edge of the room, including closets and other nooks in the space. Measuring to account for. You will want to measure and multiply the area length times the width in feet until the square footage is 1, sq. ft. and mark off this area with a marking. Next, multiply that number by pi (). The square footage of your circular room is square feet. Tips for Determining the Square. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. If the house has a full dormer, estimated square footage of the dwelling as a 1 ¾-story house. If in doubt, measure the square-foot area of the second floor. For a house, measure length and width of each room. Add those numbers together for total square footage. For property, measure each area and add. Take additional measurements of important segments, if you notice that odd shapes are emerging as you sketch the house. Take a close look at your sketch before. If a room has an alcove, such as a living room with an area for a home office, measure that space separately and add it to the overall square footage of the. Calculating Cost Per Square Foot. When painting a house, installing flooring, or building a home, the square footage of the property is often used to determine. How to find square footage of a rectangle? · Measure the length of the area and the width of the area (in feet). · Then multiply those two numbers together and. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. A square foot is a unit of measurement measuring 1 foot x 1 foot. If an area is square feet, it means the area can be divided into squares which have. If the house has a full dormer, estimated square footage of the dwelling as a 1 ¾-story house. If in doubt, measure the square-foot area of the second floor. How to Measure a Home's Square Footage Square footage is calculated by multiplying the length and width of a space in feet, which gives you the total square. To get the total square footage of a house or apartment, measure the square footage of each room or space and add them together. Calculating a room's square. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the outside. You can get accurate measurements using a tape measure or a laser measuring device. Make sure you round each measurement to the nearest foot after obtaining the. If the parcel is rectangular, length times width equals area. If you measure in feet, your area will be in square feet. Otherwise, you can look.

Closing Cost On 220k House

On average mortgage closing costs can range anywhere from 2% to 5% of the loan amount. So as an example, a loan amount of $, would have a closing cost of. Use our free USDA mortgage calculator to obtain a quick estimate of what your new home will cost closing costs and non-loan related closing costs. Read more. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. You may also be offered a no-closing-cost refinance option. However, this choice isn't free — your lender will simply raise your interest rate or increase your. Closing Costs. You can expect to pay an additional to 5% of the total loan amount in closing costs when buying a home in Georgia, so make. New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. Use our free Florida mortgage closing costs calculator to quickly estimate your closing expenses on your home mortgage. Includes taxes, insurance, PMI. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but. On average mortgage closing costs can range anywhere from 2% to 5% of the loan amount. So as an example, a loan amount of $, would have a closing cost of. Use our free USDA mortgage calculator to obtain a quick estimate of what your new home will cost closing costs and non-loan related closing costs. Read more. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. You may also be offered a no-closing-cost refinance option. However, this choice isn't free — your lender will simply raise your interest rate or increase your. Closing Costs. You can expect to pay an additional to 5% of the total loan amount in closing costs when buying a home in Georgia, so make. New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. Use our free Florida mortgage closing costs calculator to quickly estimate your closing expenses on your home mortgage. Includes taxes, insurance, PMI. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but.

What You Should Know · Closing costs are the fees that are paid by both the seller and buyer of a home for various services that are required before closing on. South Carolina closing costs. · The typical closing cost for a no cash-out refinance in South Carolina is around $ · The typical closing cost for a home. Manufactured homes, or mobile homes that are not permanently affixed, have a fixed rate of %. Other Common Fees Paid at Closing. Aside from the VA funding. closing costs. The money gives the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing. When. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. Closing Costs. -. Year, Beginning Balance, Total Payment, Principal, Interest The total cost of home ownership is more than just mortgage payments. In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. It will help you determine what size down payment makes. Monthly housing expenses. Monthly outlay that includes monthly mortgage payment plus additional costs like property taxes and homeowners insurance, as well as. Purchase price: Closing costs are often estimated to be between 2% and 5% of the final sale price of your house, according to Zillow. · Down payment: Many assume. I'd say a safe estimate for your closing costs is % of the loan, for what that's worth; in your case that's around $, Upvote. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. Buyer closing costs in Ohio ; Owner's title insurance, $1, ; Prorated property tax, Varies ; Conveyance Fee, Typically paid by seller ; Total, $6, Closing Costs: Closing costs can be negotiated between the buyer and seller. How do you calculate closing costs on a house? Throughout the home loan process, your lender will utilize a number of third-party services required to complete. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility. You'll get a low rate, custom terms, and a fast closing. Get started today. Refinance Your Mortgage Purchase A New Home. Monthly Payment $1, Principal. Purchase price: $,; Down payment: $15, (5%); Closing costs: $9, (3%); Total cash needed: $24, First-time home buyers are. House Price, $, ; Loan Amount with Upfront MIP, $, ; Down Payment, $17, ; Upfront MIP, $8, ; Total of Mortgage Payments.

Reit Storage Facilities

is a real estate investment firm focused on acquiring, owning and managing self-storage facilities across the U.S. self-storage REITs, to manage daily. The taxpayer intended to make electricity available in storage areas to power and charge tenant equipment and in parking areas through EV stations for tenants. We'll use the rest of this article to discuss the general considerations of investing in self-storage properties via both REITs and syndications. storage REIT, Storage Equities Inc., and re-structured as a Cube Smart is a real estate investment trust that invests in self-storage facilities. High liquidity: Many REITs trade publicly. This makes shares in a self-storage REIT far more liquid than most other real estate investments. For investors who. A definitive agreement to merge SST IV and SmartStop Self Storage REIT, Inc., (SmartStop) in an all-stock transaction valued at $ million. REITs, or real estate investment trusts, are one of the best ways to invest your money in self-storage. Investing your money in shares of these firms allows. Life Storage, Inc. is a fully integrated, self-administered and self-managed real estate investment trust (REIT) that acquires and manages self-storage. One excellent means of getting into the self storage industry is to invest in real estate investment trusts, commonly known as REITs. Self storage REITs own and. is a real estate investment firm focused on acquiring, owning and managing self-storage facilities across the U.S. self-storage REITs, to manage daily. The taxpayer intended to make electricity available in storage areas to power and charge tenant equipment and in parking areas through EV stations for tenants. We'll use the rest of this article to discuss the general considerations of investing in self-storage properties via both REITs and syndications. storage REIT, Storage Equities Inc., and re-structured as a Cube Smart is a real estate investment trust that invests in self-storage facilities. High liquidity: Many REITs trade publicly. This makes shares in a self-storage REIT far more liquid than most other real estate investments. For investors who. A definitive agreement to merge SST IV and SmartStop Self Storage REIT, Inc., (SmartStop) in an all-stock transaction valued at $ million. REITs, or real estate investment trusts, are one of the best ways to invest your money in self-storage. Investing your money in shares of these firms allows. Life Storage, Inc. is a fully integrated, self-administered and self-managed real estate investment trust (REIT) that acquires and manages self-storage. One excellent means of getting into the self storage industry is to invest in real estate investment trusts, commonly known as REITs. Self storage REITs own and.

Exchange-traded funds (ETFs) offer investors a different option to REITs and DSTs for self-storage. These funds act as security that tracks assets while. SmartStop is a technology-driven self-managed REIT with a fully integrated operations team of approximately self storage professionals. You can invest in self-storage facilities in many ways. The easiest of those is to buy shares in a publicly-traded REIT that owns and operates storage. GCREIT is providing floating rate whole note financing for the acquisition of two newly constructed class A+, climate controlled self-storage facilities. Global Self Storage, Inc. is a self-administered and self-managed real estate investment trust ("REIT") focused on the ownership, operation, acquisition. Extra Space Storage is a real estate investment trust (REIT) and the largest operator of self storage facilities in the U.S. Learn more about our company! Carey Inc., recently acquired a stake in six Secure Self Storage facilities in New York. The REIT paid a total of $ million in three separate deals for. FPRO · Fidelity Real Estate Investment ETF · Global Real Estate ; RWR · SPDR Dow Jones REIT ETF · Real Estate ; XLRE · Real Estate Select Sector SPDR Fund · Real. SST VI is a Maryland corporation that elected to qualify as a REIT for federal income tax purposes. SST VI's primary investment strategy is to invest in income-. Self-storage facilities are adopting kiosk-shaped security robots for Riding the Wave: Self Storage Growth Post-REITs' Pause. [Self storage](https. REITs, or real estate investment trusts, are one of the best ways to invest your money in self-storage. Investing your money in shares of these firms allows. Passive Investing. When you invest in a self-storage REIT, this allows you the freedom of being a truly hands-off, passive investor. All aspects of the. Key highlights show self-storage, REIT is positioned to capture and hold market share due to sophisticated internet marketing and revenue management. Our investment specialists have experience handling all types of storage facilities and understand the divergent needs of private investors, REITs and. Extra Space Storage ($EXR) leadership, quarterly reports, stock price, SEC filings, press releases, presentations, and more. Storage is unlike most other real estate sectors in that it thrives on change rather than economic growth. Its demand drivers rely on demographics and life. Just like other commercial real estate investments, self-storage properties are listed and sold based on cap rates, which directly relate to the investments NOI. is a real estate investment firm focused on acquiring, owning and managing self-storage facilities across the U.S. self-storage REITs, to manage daily. Our more than 3, facilities across the United States serve approximately two million customers. We are a member of the S&P and FT Global Our common. (SST VI) was branded under real estate investment trust (REIT) CubeSmart. The property in the Diamond State Industrial Park sold for about $ million. It.

Best Loan Percentages

The lower your personal loan interest rate, the less you'll pay to borrow money. This scenario shows how interest rates affect the cost of a personal loan. Additionally, the current national average year fixed mortgage rate increased 1 basis point from % to %. The current national average 5-year ARM. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Signature Loan Fixed Rate: APR = Annual Percentage Rate. Some restrictions may apply. Published rates are the lowest rates available for each loan type. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. best rate available. How. LightStream online lending offers unsecured personal loans for auto, home improvement and practically anything else, at low rates for those with good credit. According to the Federal Reserve, the average personal loan interest rate was % as of November If you are offered a loan with a rate below this. 1. A good credit score. Getting the best rate on a personal loan is no secret — the higher your credit score, the more likely you are to get a better interest. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best. The lower your personal loan interest rate, the less you'll pay to borrow money. This scenario shows how interest rates affect the cost of a personal loan. Additionally, the current national average year fixed mortgage rate increased 1 basis point from % to %. The current national average 5-year ARM. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Signature Loan Fixed Rate: APR = Annual Percentage Rate. Some restrictions may apply. Published rates are the lowest rates available for each loan type. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. best rate available. How. LightStream online lending offers unsecured personal loans for auto, home improvement and practically anything else, at low rates for those with good credit. According to the Federal Reserve, the average personal loan interest rate was % as of November If you are offered a loan with a rate below this. 1. A good credit score. Getting the best rate on a personal loan is no secret — the higher your credit score, the more likely you are to get a better interest. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best.

A good interest rate for an unsecured personal loan can range anywhere from % to %. However, you will likely need to have excellent credit to qualify. Compare current personal loan interest rates from a comprehensive list of lenders. All personal loan APR rates below are shown with the Autopay Discount Not all borrowers receive the lowest rate. Lowest rates reserved for the. As of today, September 8th, , the year fixed VA loan purchase rate is % — higher compared to last week's average. Today's year fixed VA refinance. Your Annual Percentage Rate (APR) will be based on the amount of credit requested, loan term and your credit score. The lowest rate available assumes excellent. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Understand how federal student loan interest is calculated and what fees you may need to pay. A good personal loan interest rate is one that's lower than the national average, which is %, according to the most recently available Experian data. How do. When you look at the amortization schedule for your loan, you'll see exactly how each payment will get split between principal and interest. By using the loan. +APR= Annual Percentage Rate. *Qualification restrictions apply. Rates shown are lowest rate. Other rates and terms are available. Rate, term and approval based. Current mortgage rates by loan type ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; FHA year fixed. Check personal loan rates for free in 2 minutes without affecting your credit score. Loan amounts from $ to $ No hidden fees. A good interest rate on a personal loan is generally one that's at or below the national average. Lenders will also consider your creditworthiness when. The lowest APR is available on loans of $10, or more with a term of months, a credit score of or greater and includes discount for automatic. A mortgage interest rate is the percentage you pay to borrow money for a home loan. The best way to understand how mortgage rates work is to see them in. The total annual cost of your loan, including interest rate and origination fee, and the true cost of borrowing money. Use APR to compare loan costs across. Explore our loan options to find the best way to finance your purchase. Jump to a Loan Rate. Personal Unsecured Loans. Car Loans. Recreational Vehicle (RV). Over 30 years, an interest rate of % costs $, more than an interest rate of %. A good interest rate is typically one that's lower than the national average. You may get a better deal if you have a strong income and credit history or can. Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $

Best 3 Yr Cd Rates

With uncertainties about further rate increases and the possibility of rate cuts this year, it might be an opportune time to think about an investment strategy. Start with a great rate, plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term if our rate for your term. Discover the best 3-year CD rates and maximize your savings potential. The top 3-year CD rate of September pays % APY. We review our list daily. Synchrony Bank has more CDs than many banks, offering terms from three months to five years. The short- to medium-term products are particularly impressive. The Best Bank for Your Buck CD Rate Comparison. Swipe/scroll to view full table. Financial Institution, 6 Month CD APY*, 1 Year CD APY*, 3 Year CD APY*, 5 Year. Lock in a great rate and peace of mind · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. A Certificate of Deposit (CD) rate you can take to the bank · Now % APY CD for a limited time. · High-earning savings when you don't need immediate access to. The best 3-year certificates of deposit (CDs) are paying savers over 4% APYs, but rates may not stay this high for long. With uncertainties about further rate increases and the possibility of rate cuts this year, it might be an opportune time to think about an investment strategy. Start with a great rate, plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term if our rate for your term. Discover the best 3-year CD rates and maximize your savings potential. The top 3-year CD rate of September pays % APY. We review our list daily. Synchrony Bank has more CDs than many banks, offering terms from three months to five years. The short- to medium-term products are particularly impressive. The Best Bank for Your Buck CD Rate Comparison. Swipe/scroll to view full table. Financial Institution, 6 Month CD APY*, 1 Year CD APY*, 3 Year CD APY*, 5 Year. Lock in a great rate and peace of mind · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. A Certificate of Deposit (CD) rate you can take to the bank · Now % APY CD for a limited time. · High-earning savings when you don't need immediate access to. The best 3-year certificates of deposit (CDs) are paying savers over 4% APYs, but rates may not stay this high for long.

As of September 9, , the bank or credit union with the highest CD rate is % with Financial Partners Credit Union. The minimum account opening deposit is. Best CD Rates of September ; EFCU Financial, %, $ ; Lafayette Federal Credit Union, %, $ ; Vibrant Credit Union (30 months), %, $5. 3 great reasons why you should open a CD account. More for your money. CDs offer our most competitive, promotional rates - and great returns. Guaranteed. Online CD Rates – 3-Year CDs. Compare rates on 3 year CDs from banks and credit unions. Use the filter box below to customize your results. Also, try our Early Withdrawal Penalty Calculator. Certificates of Deposit for Personal ; 3 Months, $1,, %, %, Visit or Call ; 6 Months, $1,, %, %, Open An Account. Latest in CD Rates · Best 1-Year CD Rates for September · Top CD Rates Today: September 13 — Earn Up To % APY. Lafayette Federal Credit Union has the best 2-year, 3-year, 4-year, and 5-year CD rates available. These CDs also stand out because they have a $ minimum. Summary of the highest CD rates ; Sallie Mae certificates of deposit · % · % · $2, ; My eBanc Online Time Deposit · % · % · $5, ; Bread Savings. CD Renewal Rates ; Renewed 1-year CD, %, % ; Renewed 2-year CD, %, % ; Renewed 3-year CD, %, %. Best 3-Year CDs September · American 1 Credit Union. APY: %. Minimum Balance: $ · The Federal Savings Bank. APY: % · NexBank. APY: % · Lafayette. The 1-year CD is often the shortest CD maturity that offers the best rate advantage over savings accounts. Shorter-term CDs, such as 3-month or 6-month CDs. BMO Alto. % APY. ; Bread Savings™. % APY*. ; National average for 1-year CD. %. ;» See more best 1-year CD rates ; CURRENT CD RATES: 3-year. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Best CD Rates ; Valley Direct, 3 Year CD, % - (steady @ %) ; TAB Bank, 6 Month CD, % ↑ (up from %) ; Banesco, 6 Month CD, % ↓ (down from %). The best CD rate on a 1-year CD is % APY from EagleBank. You can open an online CD if you do not live near a branch in Maryland, Virginia, or Washington, DC. Synchrony Bank offers many terms of CDs with terms ranging from three months to five years. Synchrony Bank also offers an month no-penalty CD and a two-year. %. $2, Save now. Ponce Bank. +3. High-Yield CD | 3 months year CDs), as of January Meanwhile, the average interest rate on a one.

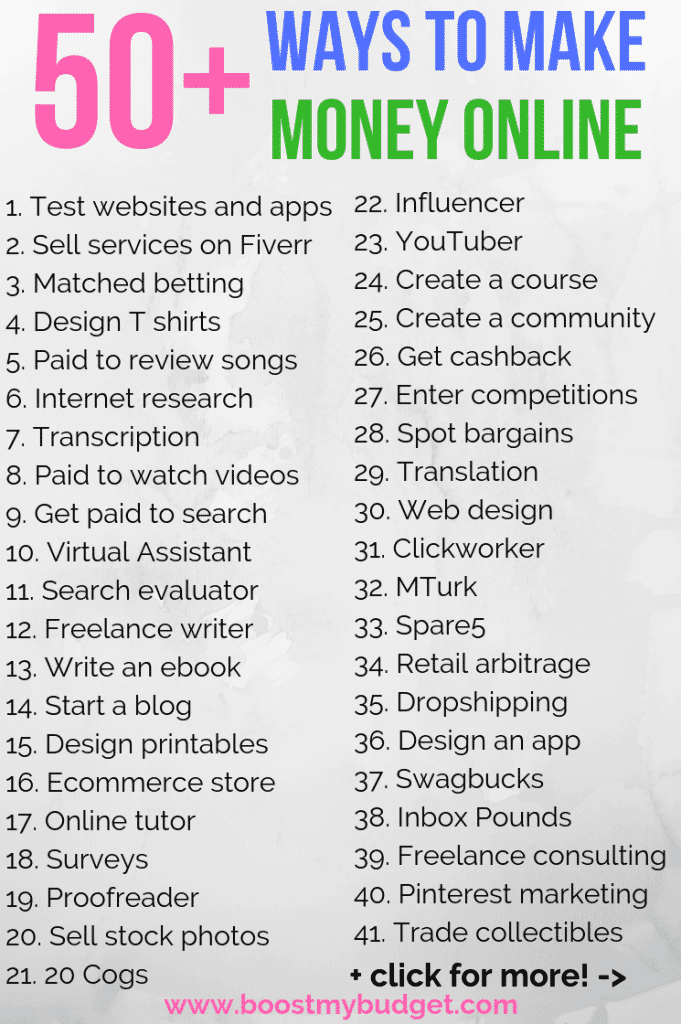

Ways To Make Money Online At 18

Babysit for family and friends. · Tidy up people's lawns. · Ask for an allowance. · Help an older person. · Walk the neighborhood dogs. · Sell stock photos online. Referral programs can be a great way to make extra money online. You can share products you love with your friends, family, and social media followers. Make Money Blogging. · Join an Affiliate Program. · Build an eCommerce Website. · Open a Dropshipping Store. · Create an Online Course. · Tutor. If you're trying to maximize your income by any means necessary, then you can definitely look into taking surveys online. By just answering questions on survey. Fiverr is a popular freelancing platform that allows you to make money by offering many different services (see a few examples below). Most jobs. How It Works: Take Paid Surveys Online - Survey Junkie; Survey Junkie Review Here's EXACTLY How Much I Made! - Money Done Right; How Do I Become a Tasker? Unlocking the Potential of Earning Online · E-Commerce Ventures: · Content Creation and Monetization: · Freelancing and Remote Work: · Affiliate. What Are Jobs Teens Can Do Online? · Become a virtual assistant · Tutor online · Stream video games · Get involved in direct sales · Flip items · Create websites. If your interested in earning a little bit of income on the side within a day to a few weeks then open up an ebay about and start selling things. Babysit for family and friends. · Tidy up people's lawns. · Ask for an allowance. · Help an older person. · Walk the neighborhood dogs. · Sell stock photos online. Referral programs can be a great way to make extra money online. You can share products you love with your friends, family, and social media followers. Make Money Blogging. · Join an Affiliate Program. · Build an eCommerce Website. · Open a Dropshipping Store. · Create an Online Course. · Tutor. If you're trying to maximize your income by any means necessary, then you can definitely look into taking surveys online. By just answering questions on survey. Fiverr is a popular freelancing platform that allows you to make money by offering many different services (see a few examples below). Most jobs. How It Works: Take Paid Surveys Online - Survey Junkie; Survey Junkie Review Here's EXACTLY How Much I Made! - Money Done Right; How Do I Become a Tasker? Unlocking the Potential of Earning Online · E-Commerce Ventures: · Content Creation and Monetization: · Freelancing and Remote Work: · Affiliate. What Are Jobs Teens Can Do Online? · Become a virtual assistant · Tutor online · Stream video games · Get involved in direct sales · Flip items · Create websites. If your interested in earning a little bit of income on the side within a day to a few weeks then open up an ebay about and start selling things.

Begin a cooking blog for kids: blogging can be lucrative once you have enough traffic and page views to earn money from advertising. Offer cooking classes for. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. 1. Online Surveys · 2. Write a Book and Sell It On Amazon · 3. Amazon FBA · 4. Dog Walking · 5. Baby Sitting · 6. Flip Items on Facebook Marketplace · 7. Start a. Participating in online surveys and market research can be a strategic way for college students to earn extra money without a significant time commitment. Take Online Surveys; Watch Ads for Money; Play Video Games; Review Songs; Test Products; Take Pictures with Your Phone; Sell Stuff Online; Online Tutoring. Freelancing is one of the most popular ways of making money online. Several freelancing projects can be taken up by students to earn money. Taking up part-time. For those who prefer a more passive approach to earning extra cash, you could take online surveys while binging your favorite Netflix shows. What are easy side. Making money from online surveys In your spare moments, you can participate in paid surveys on sites such as Toluna, Branded Surveys, LifePoints, InboxDollars. You can sign up on the Amazon Mechanical Turk website. Total time: variable depending on the jobs you sign up for. Setup: 30 seconds to create your account. How. There are right ways and wrong ways to make money fast. We'll show you the difference and help you choose the best option for your situation. Teens who are interested in fashion and clothing may want to make money by selling clothes online. Poshmark and Depop are two popular platforms, but you could. Kids can make money with traditional jobs like babysitting, cutting lawns, washing cars, or working part-time in restaurants or retail. · Online opportunities. 1. Taking Online Surveys. Taking surveys online is one of the easiest ways to make money online. · 2. Playing Games Online. Playing games online is a feature. Part-Time Online Jobs · Cold-calling customers and offering sales promotions · Maintaining accounts or customer databases · Generating revenue through sales. Earning through video game streams is also popular, especially with options to monetise content. GoHenry says “as many as 18% of kids earn money through online. 11 ways teens could make money · Selling second-hand clothes · Making jewellery · Social media manager · Sign up to paid surveys · Become an influencer · Livestream. Swagbucks – Earn up to $35 a survey with this mega-popular app, and get a $10 bonus just for signing up! Survey Junkie – Take 3 surveys a day and earn up to. There are right ways and wrong ways to make money fast. We'll show you the difference and help you choose the best option for your situation. If you're more confident with public speaking and have solid story-telling skills, you can also start a YouTube channel to make money online. Again, sticking to. As a teen, there are some ways you can get extra cash. One of them is taking online paid surveys for teens online. They are usually very easy to take and will.

1 2 3 4 5