jilergonomics.ru Overview

Overview

Debt Consolidation Fixed Rate

This is a personal loan that helps you combine your debt from different creditors, with the potential for substantial savings on interest. People often use unsecured personal loans, which means no collateral is needed, to consolidate credit card debt. They can also use debt consolidation to combine. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. The Interest on a debt consolidation loan should go for somewhere between 6% and 20%. Debt consolidation loans are offered by banks, credit unions and online. A debt consolidation loan is one way to refinance your credit card debt. It can be especially beneficial for people who are juggling credit card bills from. Fixed rates from % APR to % APR. APR reflects the % autopay discount and a % direct deposit discount. SoFi Platform personal loans are made. Truliant debt consolidation loans help members combine debt into a single loan and pay off others loans. This helps them to concentrate on paying down debt with. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. This is a personal loan that helps you combine your debt from different creditors, with the potential for substantial savings on interest. People often use unsecured personal loans, which means no collateral is needed, to consolidate credit card debt. They can also use debt consolidation to combine. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. The Interest on a debt consolidation loan should go for somewhere between 6% and 20%. Debt consolidation loans are offered by banks, credit unions and online. A debt consolidation loan is one way to refinance your credit card debt. It can be especially beneficial for people who are juggling credit card bills from. Fixed rates from % APR to % APR. APR reflects the % autopay discount and a % direct deposit discount. SoFi Platform personal loans are made. Truliant debt consolidation loans help members combine debt into a single loan and pay off others loans. This helps them to concentrate on paying down debt with. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR.

Why choose Upstart for a debt consolidation loan? · Flexible loan amounts · Fixed rates and terms · No prepayment fees. Example chart shows calculations based on a 5 year SoFi Personal Loan with a fixed rate of % APR, which is the rounded average median funded APR. If you're looking to consolidate credit cards, loans or medical bills PNC has some great options for you. You may be able to take control of your spending. A debt consolidation loan is most often a personal loan. It's an installment loan that you borrow in one large lump sum and then pay off over a predetermined. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month —. As of July , interest rates for debt consolidation loans ranged from % to %, depending on the amount borrowed, what type of lender it's borrowed. Monthly obligations made manageable. Combine up to $, of debt, including credit card balances, with a fixed rate as low as % APR. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. A debt consolidation loan offers consumers the ability to roll all their debts into a single loan with just one monthly payment. These types of loans are. Fixed rates from % APR to % APR reflect the % autopay interest rate discount and a % direct deposit interest rate discount. SoFi rate ranges. Why we picked LightStream: LightStream offers debt consolidation loan rates of % to % APR. APR measures the true cost of a loan, both interest rates. What is a PenFed Debt Consolidation Loan? This is a personal loan that helps you combine your debt from different creditors, with the potential for substantial. Stay on track with becoming debt-free with our debt consolidation loans. We'll help streamline your budget into one simple payment, saving you time and. Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation/refinancing · Loan amounts. $5, to $40, · Terms. 2 to 5 years · Credit needed. Your APR will be between % and % based on creditworthiness at time of application for loan terms of months. For example, if you get approved for. Compare debt consolidation loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5. It allows you to merge them into one loan with a fixed interest and a single monthly payment. This eliminates the stress of managing multiple bills and due. What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment.

Can You Cash App To Paypal

How do I add cash to PayPal at a store? To add cash to your PayPal balance, go to your Accounts in the PayPal app while you're at the store. Then, select Add. If needed, you can add money to your Send Account by clicking Manage Balance > Add Money. 2. Open Venmo's app or PayPal's app or website (wherever you want to. Unfortunately, you can't directly move money from Cash App to PayPal, but you do have options. Whether you use your bank account as a middleman or the Cash Card. Tap Payment methods accepted and select Cash App Pay. Review the invoice details and tap Send invoice. Customers who receive an invoice from you will see the. There is no direct way to transfer money from Cash App to PayPal, but you can use one of the two workarounds described above. You can send funds to and from your One Cash account using peer-to-peer service apps such as Cash App, Venmo, Paypal, and others. PayPal is a smart and secure way to shop in-store and online, earn cash back on brands you love, send money to friends and much more. Get started in the app. Can't really say since I don't have a PayPal card. In fact I wasn't even aware they had one. May be it is only offered within the US. PayPal is an online payment system that allows you to send and receive money around the world. You can link your bank account, credit card, or debit card. You. How do I add cash to PayPal at a store? To add cash to your PayPal balance, go to your Accounts in the PayPal app while you're at the store. Then, select Add. If needed, you can add money to your Send Account by clicking Manage Balance > Add Money. 2. Open Venmo's app or PayPal's app or website (wherever you want to. Unfortunately, you can't directly move money from Cash App to PayPal, but you do have options. Whether you use your bank account as a middleman or the Cash Card. Tap Payment methods accepted and select Cash App Pay. Review the invoice details and tap Send invoice. Customers who receive an invoice from you will see the. There is no direct way to transfer money from Cash App to PayPal, but you can use one of the two workarounds described above. You can send funds to and from your One Cash account using peer-to-peer service apps such as Cash App, Venmo, Paypal, and others. PayPal is a smart and secure way to shop in-store and online, earn cash back on brands you love, send money to friends and much more. Get started in the app. Can't really say since I don't have a PayPal card. In fact I wasn't even aware they had one. May be it is only offered within the US. PayPal is an online payment system that allows you to send and receive money around the world. You can link your bank account, credit card, or debit card. You.

Here's how to pay using our website: Go to Send and Request. ; To send money on the app: Tap Send/ Request. ; Here's how to send a payment using jilergonomics.ru: Click. Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported. ATM cards, Paypal. How do I receive money using PayPal? · Go to Request · Select the person you are requesting money from · Enter the amount and add a note if you'd like · Select. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. No! There is no option to transfer money directly from PayPal to the Cash app. However, you can transfer money to your linked bank account, then to the Cash. No- but you can send money from your PayPal to your cashapp account, assuming you have a cashapp debit card and verify it with PayPal as a bank. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Add cash to your PayPal Balance Account hassle-free! Swipe your PayPal-branded Debit Card or generate a barcode in your PayPal app and provide it along with. You can connect your account to Venmo, Paypal, Cash App to transfer money received via these platforms. To learn how, go to the Main Menu. When someone pays you through Cash App or Venmo you will need to use the app to transfer funds to your linked bank account, but with PayPal, you can set it up. Yes, you can transfer money from your PayPal account to your Cash App balance. To do so, you'll need to link your PayPal account to your Cash. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. How do I add money to my PayPal balance from my bank? · Go to your Wallet. · Click Transfer Money. · Choose "Add money from your bank or debit card.' Enter the. You can now use your Fidelity account to make and receive mobile payments via Apple Pay, Venmo, PayPal and other apps. It's secure and convenient. If you're not sure if your banking institution is compatible, or you want to be notified about changes to this policy, you can always reach out to Member. Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is for; Tap Pay. How do I send money on the PayPal app? · Open the app and log in to your account. · Choose “Payments” and then “Pay.” · Enter your recipient's name, PayPal. To send your PayPal funds home to your bank account, log in to PayPal. Make sure your bank account is already linked. Then, tap 'Transfer Money.'. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. You open your account by linking a debit card, but you can also add other debit cards or payment methods. It is similar to PayPal or Venmo in that way. Cash App.

Bmo Home Equity Loan Rates

Wondering how much your HELOAN payments will be? Our calculator will determine the monthly payments based on your loan amount, term, and interest rate. Standard pricing on HELOC is Prime + %. TD may give you some flexibility on the application costs. These costs usually range from $$ Your APR for a $25, loan may be as low as % and as high as %. Your APR for a $50, loan may be as low as % and as high as %. Your APR for. BMO Smart Money CheckingNo overdraft fees · All checking accountsExplore Fixed Rate Home Equity Line of CreditLocked-in interest rates · Home Equity. Best home equity line of credit rates in USA ; The PNC Financial Services Group, Inc. % ; US Bank. % ; BMO Bank. % ; Chartway Federal Credit Union. % interest rate discount3 after the introductory period ends when you set up Auto Pay for your. BMO Harris Home Equity Line of Credit. Plus, we'll get to. Since home equity loans have a fixed interest rate and term from 5 to 20 years, you can feel secure that your monthly payment will always stay the same, no. However, BMO Bank does charge a $75 annual fee. Some lenders charge an origination fee for processing, underwriting, and funding a mortgage. Typically fees. Best home equity line of credit (HELOC) rates in September ; BMO. $25,$,, year draw/ year repay for variable-rate HELOC; year repay for. Wondering how much your HELOAN payments will be? Our calculator will determine the monthly payments based on your loan amount, term, and interest rate. Standard pricing on HELOC is Prime + %. TD may give you some flexibility on the application costs. These costs usually range from $$ Your APR for a $25, loan may be as low as % and as high as %. Your APR for a $50, loan may be as low as % and as high as %. Your APR for. BMO Smart Money CheckingNo overdraft fees · All checking accountsExplore Fixed Rate Home Equity Line of CreditLocked-in interest rates · Home Equity. Best home equity line of credit rates in USA ; The PNC Financial Services Group, Inc. % ; US Bank. % ; BMO Bank. % ; Chartway Federal Credit Union. % interest rate discount3 after the introductory period ends when you set up Auto Pay for your. BMO Harris Home Equity Line of Credit. Plus, we'll get to. Since home equity loans have a fixed interest rate and term from 5 to 20 years, you can feel secure that your monthly payment will always stay the same, no. However, BMO Bank does charge a $75 annual fee. Some lenders charge an origination fee for processing, underwriting, and funding a mortgage. Typically fees. Best home equity line of credit (HELOC) rates in September ; BMO. $25,$,, year draw/ year repay for variable-rate HELOC; year repay for.

Leverage the equity in your home – Get estimated rate and payment. Property Home Equity Loan. Home Equity Line of Credit. Other. None. GET RATES. Visit a. BMO Harris: Best for rate discount. Fifth Third Bank: Best for no closing costs. Flagstar: Best for large loans. Connexus Credit Union: Best for fair credit. Home Equity Loan Rates | Line of Credit Lenders in Skokie ; Commerce Bank. Last Updated: 08/08/ NMLS ID: % Intro APR. % After Intro Period. Closing cost discount of $ on a new BMO Harris mortgage loan with loans, home equity loans, interim, lot and recreational land loans. Auto Pay. Check our current HELOC rates and use our home equity line of credit calculator to see what you may be able to borrow based on the value of your home. Auto/Boat/RV Loans; Home Equity. what is the bonus for csl plasma this month As auto loan rates rise, the average monthly car payment for a new. Best Home Equity Loan Rates for September Homeowners can get access to a large sum of cash at a fixed rate by borrowing against their property's value. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. Your APR may be as low as % and as high as %. To qualify for the lowest rate you must meet requirements for loan amount, term length, credit history. BMO Bank Home Equity Loans FAQ Typically, borrowers with good credit can qualify for up to 85 percent of the value of the property less the balance on their. Try our home equity loan, HELOC, and auto loan calculators to find out how much you can borrow and what your payments could be. Enjoy lower rates than most other loans, and low to no closing costs · You'll only pay interest on the money you borrow. · A % discount can be included when. Adjustable Rate. If you're planning to stay in your home for a Loan · Payment Assistance for Mortgage and Home Equity · Customer support. Branch locator. BMO Bank Home Equity Loans FAQ Typically, borrowers with good credit can qualify for up to 85 percent of the value of the property less the balance on their. BMO Harris Bank created an exceptional experience across mortgage and home equity products for both consumers and lending staff. Home Equity Line of Credit and payment. Offer: Double Your Auto Pay Discount! Receive % off your interest rate for the life of your loan when you sign. Home Equity Loans & Lines of Credit Lenders in Algonquin ; Regions Bank. Last Updated: 08/08/ NMLS ID: % APR, % Rate ; Old National Bank. You will be charged a $75 annual fee on the loan opening date and each year after during the Draw Period. You may also be required to pay real estate taxes and. $ is the difference between the amount paid in interest between BMO Bank's rate at % APR compared to % APR for the Brownsburg, IN market average on a. Current BMO fixed mortgage rates · 1-year (open). %. % · 2-year. %. % · 3-year. %. % · 4-year. %. % · 5-year.

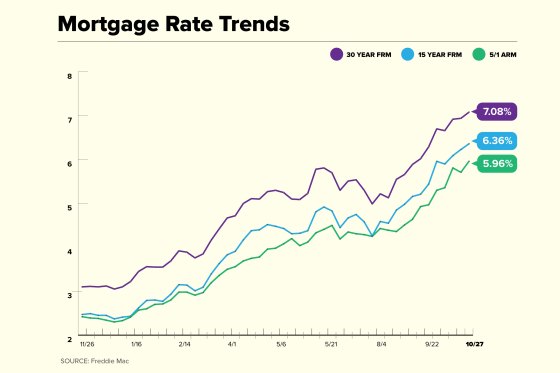

Long Term Outlook For Mortgage Rates

Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. The average year, fixed-rate mortgage soared from % the first week of January to a year high of % in late October, according to Freddie Mac. The current mortgage interest rates forecast is for rates to continue on a gentle downward trajectory over the remainder of Rates rose steadily in. 30 Yr Conventional Mortgage. Percent. Average of Month. ; 2, Oct , ; 3, Nov , ; 4, Dec , ; 5, Jan , RE/MAX: Rates will be % at the end of the 1st quarter of “Economists predict that mortgage rates will remain elevated for most of and that they. Long-term interest rates in percent · In response to strong inflation following the pandemic and Russia's war in Ukraine, the SNB – like other central banks –. forecast and long-term prediction, economic calendar, survey consensus and news Long Term Unemployment Rate · Manufacturing Payrolls · Minimum Wages · Non. The long-term outlook is for mortgage rates to start decreasing in Q3 or Q4, Inflation has slowed down, and outside of normal daily fluctuations, mortgage. Long-term interest rates forecast refers to projected values of government bonds maturing in ten years. It is measured as a percentage. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. The average year, fixed-rate mortgage soared from % the first week of January to a year high of % in late October, according to Freddie Mac. The current mortgage interest rates forecast is for rates to continue on a gentle downward trajectory over the remainder of Rates rose steadily in. 30 Yr Conventional Mortgage. Percent. Average of Month. ; 2, Oct , ; 3, Nov , ; 4, Dec , ; 5, Jan , RE/MAX: Rates will be % at the end of the 1st quarter of “Economists predict that mortgage rates will remain elevated for most of and that they. Long-term interest rates in percent · In response to strong inflation following the pandemic and Russia's war in Ukraine, the SNB – like other central banks –. forecast and long-term prediction, economic calendar, survey consensus and news Long Term Unemployment Rate · Manufacturing Payrolls · Minimum Wages · Non. The long-term outlook is for mortgage rates to start decreasing in Q3 or Q4, Inflation has slowed down, and outside of normal daily fluctuations, mortgage. Long-term interest rates forecast refers to projected values of government bonds maturing in ten years. It is measured as a percentage.

Mortgage rates will remain high in and , which will continue to impact demand and discourage home sales, especially where many homeowners still benefit. The most optimistic estimate is a drop of per cent to per cent. Lower mortgage rates increase homebuying budgets. “With less investor demand, mortgage rates stay elevated.” Chart depicts monthly average interest rate for a year mortgage during the timeframe of. Source. Bank of Canada Rate Forecast for Further Decrease in the Overnight Rate The policy rate is %, while the last inflation reading for April was. Prediction: Rates will moderate Longer term, the spread between year Treasury yields and rates on the year mortgage are still much higher than usual -. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until The next cut, he suggests, will likely occur in September as long as core CPI is +% month-over-month or lower. His prediction places the policy rate at 4%. 30 Year Conventional Mortgage. Percent Per Year, Average of Month. ; 3, Nov , ; 4, Dec , ; 5, Jan , ; 6, Feb , As of Sept. 4, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Now, the best CD rates hover around 5% APY for terms ranging from six months to a year, but these rates are unlikely to last much longer—the Federal Reserve is. The Fannie Mae Economic & Strategic Research Group offers a forecast of economic trends in the housing and mortgage finance markets Mortgage Calculator · Down. NEW Mortgage Rates Stay Boring, But For How Long? Spats of volatility in the mortgage rate world seem to last only a matter of hours recently and to occur. After hitting a peak in October, , rates have slightly eased since then. Despite the prolonged period of high rates, many housing experts predict rates will. Aspiring homebuyers waiting for mortgage rates to finally fall are unlikely to see much of a change any time soon, according to experts, as forecasts expect. Historical record of single-family, one- to four-unit loan origination estimates. Last updated August Historical Mortgage Finance Forecast. Historical. When the central bank raises the federal funds target rate, as it did throughout and , that has a knock-on effect by causing short-term interest rates. So, short-term and long-term rates decreased, and the annual averages for the two years hovered at around 3%. Present. Around July , rates began rising. In the long term, the Euro Area Interest Rate is projected to trend around percent in and percent in , according to our econometric models. After hitting a peak in October, , rates have slightly eased since then. Despite the prolonged period of high rates, many housing experts predict rates will. For those considering entering the housing market, predictions of decreasing mortgage rates can signal a potential reduction in the long-term cost of purchasing.

Full Body Car Paint Price

To refinish that car's peeling roof, you'll need to shell out between $ and $ And for a whole-body job, estimates range from $ to $2,, depending on. Since the body will be in good shape, you're probably looking around $$ You could also consider a wrap for $$ The costs to paint a car vary depending on where the work is done, the size and complexity of the vehicle to be painted, and the quality of the paint job itself. Cost is a likely factor in a wrapping vs painting decision: is it cheaper to wrap or paint a car? Paint jobs run from $ (low quality) or anywhere between. Basic costs range from $ to $ Standard: The cost of a standard paint job usually includes sanding the body and removing rust before. In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. If you're having a body shop take care of the work, you can expect to pay about $ for minor repairs. Do it at home, and touch up paint typically costs about. The answer to this question will depend on the above factors. In general, however, you can expect to pay anywhere from $$ for your car paint job. Standard paint job: The usual costs range for a paint job ranges frim $1, to $4, The cost of a good paint job usually includes sanding the body and. To refinish that car's peeling roof, you'll need to shell out between $ and $ And for a whole-body job, estimates range from $ to $2,, depending on. Since the body will be in good shape, you're probably looking around $$ You could also consider a wrap for $$ The costs to paint a car vary depending on where the work is done, the size and complexity of the vehicle to be painted, and the quality of the paint job itself. Cost is a likely factor in a wrapping vs painting decision: is it cheaper to wrap or paint a car? Paint jobs run from $ (low quality) or anywhere between. Basic costs range from $ to $ Standard: The cost of a standard paint job usually includes sanding the body and removing rust before. In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. If you're having a body shop take care of the work, you can expect to pay about $ for minor repairs. Do it at home, and touch up paint typically costs about. The answer to this question will depend on the above factors. In general, however, you can expect to pay anywhere from $$ for your car paint job. Standard paint job: The usual costs range for a paint job ranges frim $1, to $4, The cost of a good paint job usually includes sanding the body and.

Car Painting Price List in India Car Service List, Price Starts From (₹). 1. Single Door, Rs 2. Full Body, Rs 3. Front or Rear Bumper, Rs. In general, expect to pay between $ and $10, for a professional paint job. At the upper end of that price range, we find metal flake, multi-colored, and. Average cost for a decent quality paint job (single color, sanding, coats) will be between $1,$3, You can get very high quality . The average cost to paint a car ranges from $ to more than $20, What you pay depends on various factors, primarily the level of quality you're looking. How much it costs to paint a car depends on several factors, including vehicle size and type of paint, but the average for a mid-range job is $ to. Free online estimate for auto body repair and car painting near me. Find a local Maaco car paint shop near me. Click here to get a preliminary estimate. We provide THE best Full Body Repair and Restoration Service near you in Gurgaon(gurgaon sector 23) for your car. The impact force, the type of material used for the car body, and the Curious about the full car painting cost in India? We offer transparent. High quality car paint and auto body supplies since Enjoy competitive prices and FAST, secure shipping on automotive paints! Standard paint job: The usual costs range for a paint job ranges frim $1, to $4, The cost of a good paint job usually includes sanding the body and. Showroom car paint service can cost $20,+. What Factors Affect Cost? We The bigger the car, the more time and paint is necessary to complete the job. Custom Paint Work · Full Body Paint Work (Exterior Only) · For as low as the $ · Lowest prices in San Diego! · Estimate will take less than 10 minutes! The answer to this question will depend on the above factors. In general, however, you can expect to pay anywhere from $$ for your car paint job. CostHelper readers report paying $$ for a basic auto paint job at an average price of $; about a third of these readers say they are unhappy with the. Restoration Shop - Gunmetal Grey Metallic Acrylic Urethane Auto Paint - Complete Gallon Paint Kit - Price & Deals. Price. $6 – $+. Deals & Discounts. The cost of a basic paint job can range from $ to $ Detailing with a standard paint job usually involves sanding the body and removing any rust before. auto paint · automotive paint gallon · auto paint touch up · auto body filler. More results. Car Scratch Repair Kit,Deep Scratch Repair Kit for Cars,Car Paint. Car Full Body Repainting starting from Rs in Chennai only on GoBumpr! 5 Year Warranty on Repainting. OEM Paints for a Factory Finish. We're your auto body paint shop whether you need a paint job for a car, truck, or other auto vehicle. We are committed to making the experience easy with. The average cost for a professional dealer or auto body shop can charge anywhere from $$ in For small jobs it could be anywhere from $$

What Does It Mean To Default On A Loan

What Happens When a Loan is in Default? After several missed payments, a loan may move beyond delinquency status and go into default. Once a delinquent account. Highlights: Lenders consider your credit scores as a significant factor when deciding whether to approve you for a personal loan and at what terms. Default is failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, you will default if you have not. After days, or roughly nine months, of past-due payments: Your federal loan goes into default and you could see your debt go to collections. Federal student. WHAT DOES DEFAULT MEAN? Default on a Federal Family Education Loan Program WHAT SHOULD I DO IF MY STUDENT LOAN DEFAULTS? Contact us immediately at. If payments are late, it's considered a delinquency, leading to fines, but complete non-payment constitutes a default. This can result in legal actions, seizure. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment. Defaulting on a loan means that you have not met your obligations when it comes to the terms of repayment. It can mean missing a payment, being late on a. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment. What Happens When a Loan is in Default? After several missed payments, a loan may move beyond delinquency status and go into default. Once a delinquent account. Highlights: Lenders consider your credit scores as a significant factor when deciding whether to approve you for a personal loan and at what terms. Default is failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, you will default if you have not. After days, or roughly nine months, of past-due payments: Your federal loan goes into default and you could see your debt go to collections. Federal student. WHAT DOES DEFAULT MEAN? Default on a Federal Family Education Loan Program WHAT SHOULD I DO IF MY STUDENT LOAN DEFAULTS? Contact us immediately at. If payments are late, it's considered a delinquency, leading to fines, but complete non-payment constitutes a default. This can result in legal actions, seizure. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment. Defaulting on a loan means that you have not met your obligations when it comes to the terms of repayment. It can mean missing a payment, being late on a. In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment.

Loan defaults should be avoided at all costs. When a default occurs, the borrower gives full control over the consequences to the lender. A defaulted loan is listed as adverse credit on your credit report, which can mean not being able to obtain a credit card, car loan or mortgage. A defaulted. When you miss too many payments, your loan eventually becomes a "deemed distribution." This means that the unpaid balance on your loan is treated as taxable. The Program will process a loan default when it determines a default has occurred (loan defaults occur on a quarterly basis). However, if you determine that a. Your loan account remains delinquent until you repay the past due amount or make other arrangements, such as deferment or forbearance, or changing repayment. Incarcerated borrowers with most types of loans are eligible for Fresh Start. What is student loan default? For most federal student loans, default means that. Understanding Loan Default. Loan default happens when a borrower fails to make the required payments in a timely manner or ceases to make payments completely. What Happens If You Default on Your Mortgage Loan. Once you default on your mortgage loan, the lender can demand that you repay the entire outstanding balance. Default means failing to keep the promises agreed to in a contract. If you take a loan and do not make the payments described in the loan agreement, you have. Unsecured loans are loans without any defined collateral from the borrower. DesMarteau said it's rare that a traditional bank would approve a loan without some. An event of debt default occurs when one or more terms of a loan agreement are violated by a borrower. · A missed interest (or principal and interest) payment is. As a borrower of a Direct Loan or a Federal Family Education Loan Program loan, you move into default when you do not make any payments for more than days. Default occurs when a borrower has not made payments for more than days, and the guaranty agency purchases the loan from your lender. This has serious. Loan default happens when someone who borrowed money can't make their payments on time, as agreed in the loan agreement. This can happen with different types of. When taking out a loan, you make a financial promise to pay back what you owe. And, regardless of the circumstances or situation, when you fail to repay the. A loan goes into default—which is the eventual consequence of extended payment delinquency—when the borrower fails to keep up with ongoing loan obligations or. Your SBA loan usually goes into default when you repeatedly fail to meet the legal conditions of the loan agreement. It will first be considered delinquent. Being in default is defined differently for different loans. Basically, it means being delinquent in repaying a student loan more than a certain number of days. While federal education loans define a default as occurring after days of non-payment, for private student loans a loan is considered in default after This is the most severe form of loan default and fraud that involves intentionally failing to make the first payment. What does early default mean? Early.

2 3 4 5 6