jilergonomics.ru Community

Community

How Do You Get A Joint Bank Account

Opening a joint account adds a financial link to the other person. This means companies will look at both of your credit histories as part of any credit checks. Most joint bank accounts come with what's called the "right of survivorship," meaning that when one co-owner dies, the other will automatically be the sole. Find the best joint bank account for you · Photo ID. · Social Security number. · Proof of address. · Other general information, such as birth dates. · Opening. Checking Accounts. . Choose a bank account. Most popular. Overdraft fee-free How do I open a joint checking account? Joint checking accounts must be. How to open a joint bank account. Accounts can be opened in person at a branch office or online, depending on the bank you choose. If you plan to do it in. As far as I was concerned, a joint bank account was de rigueur, like sharing a bed. I soon learned that married life was complicated—that, in fact, there are. How to open a joint bank account · Identification · Current address · Social Security number · Date of birth · Funds for an opening deposit. Most banks will. Create a new account which you will both share · One of you opens a new account. · Wait for a confirmation email informing you the account is ready to use. To open a joint account, you'll need to provide proof of identification and proof of address. Depending on your bank, you may need to provide more than one. Opening a joint account adds a financial link to the other person. This means companies will look at both of your credit histories as part of any credit checks. Most joint bank accounts come with what's called the "right of survivorship," meaning that when one co-owner dies, the other will automatically be the sole. Find the best joint bank account for you · Photo ID. · Social Security number. · Proof of address. · Other general information, such as birth dates. · Opening. Checking Accounts. . Choose a bank account. Most popular. Overdraft fee-free How do I open a joint checking account? Joint checking accounts must be. How to open a joint bank account. Accounts can be opened in person at a branch office or online, depending on the bank you choose. If you plan to do it in. As far as I was concerned, a joint bank account was de rigueur, like sharing a bed. I soon learned that married life was complicated—that, in fact, there are. How to open a joint bank account · Identification · Current address · Social Security number · Date of birth · Funds for an opening deposit. Most banks will. Create a new account which you will both share · One of you opens a new account. · Wait for a confirmation email informing you the account is ready to use. To open a joint account, you'll need to provide proof of identification and proof of address. Depending on your bank, you may need to provide more than one.

If you're adding a joint owner to an existing account: Visit your local Santander Bank branch with the person you want to add to your account. Make sure both. John and Mary Smith have a joint savings account with $, at Any Bank. This is their only account at this IDI and it is held as a “joint account with right. To open a joint Rewards Checking account, an eligible Card Member must first apply and be approved for an individual Rewards Checking account. That account. Tax Issues. Deposits placed into a joint account could be subject to a tax under many circumstances. Therefore, if you deposit $50, into an account that. Learn more about how to apply to open a bank account or joint bank account at Bank of America. Review what you need to open a bank account online today. Opening a joint checking account is very similar to opening an individual checking account. Select "joint account" when you fill out your application. A joint checking account is a bank account shared between two individuals. With a joint checking account, both account owners have full access to account. Existing account holders can visit any Huntington branch to convert their personal account into a joint bank account. All account holders, including the. {0} · Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single direct deposit of at least $ {0} · Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single direct deposit of at least $ Yes. I did this with Ally -- you first open a new account with an individual owner, and then send in a form (along with copies of identification). SoFi joint bank accounts have no account fees, unlimited transfers, and high APY. See why SoFi was voted the Best Joint Checking Account of All our accounts can be opened jointly. Simply select the Joint option when applying. Learn what you'll need to apply online. A joint checking account is a bank account shared between two individuals. With a joint checking account, both account owners have full access to account. How do you talk to your partner about joint checking accounts? · Key takeaways · Decide what you want to get out of the joint account · Keep separate accounts. A joint account is a bank or brokerage account shared by two or more individuals. · Joint account holders have equal access to funds but also share equal. If you and your significant other have decided on spending your life together, ask each other if you should combine your financials accounts now that you're. You can apply for a joint bank account online. You will need both party's To apply for a joint account, please visit our Checking page and click on Open an. If you both want guilt-free spending, then keep separate HYSAs and credit cards. The joint checking is the shared resource pool of the couple. Because the income from both parties is combined, the balance on a joint checking account will be higher than it would be for two individual accounts. This.

Where Can I Get 10000

Reference guide on the IRS/FinCEN Form , Report of Cash Payments Over $10, Received in a Trade or Business. This guide is provided to educate and. 6, - 10, pts. 10, - 20, pts. 15, - 25, pts. Partner airlines. 6, pts. 15, pts. - 1, Air Canada. 10, - 15, pts. 15, -. You have several different types of lenders available when applying for a $10, personal loan, including online lenders, banks and credit unions. Online. Looking for a £ personal loan? Use our online loan calculator to get a quote. Apply online and, if accepted, £10k could be with you in two working. For a motor vehicle with a GVW over 10, pounds and which travels only in Mississippi, you will register the vehicle at your local county Tax Collector's. $10,, 5, %, %, $, $ $15,, 3, %, %, $, $ Example 1: A $10, loan with a 5-year term at 13% Annual Percentage Rate. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %.Footnote. $10, ‐ $24,; $25, ‐ $49,; $50,+. Go back. Next. Question 5. Will Use the equity in your home to pay for home improvements, consolidate debt. Other limitations may apply. 2Term limits based on amount borrowed. $10, borrowed at % APR* for 36 months = $ per month. Reference guide on the IRS/FinCEN Form , Report of Cash Payments Over $10, Received in a Trade or Business. This guide is provided to educate and. 6, - 10, pts. 10, - 20, pts. 15, - 25, pts. Partner airlines. 6, pts. 15, pts. - 1, Air Canada. 10, - 15, pts. 15, -. You have several different types of lenders available when applying for a $10, personal loan, including online lenders, banks and credit unions. Online. Looking for a £ personal loan? Use our online loan calculator to get a quote. Apply online and, if accepted, £10k could be with you in two working. For a motor vehicle with a GVW over 10, pounds and which travels only in Mississippi, you will register the vehicle at your local county Tax Collector's. $10,, 5, %, %, $, $ $15,, 3, %, %, $, $ Example 1: A $10, loan with a 5-year term at 13% Annual Percentage Rate. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %.Footnote. $10, ‐ $24,; $25, ‐ $49,; $50,+. Go back. Next. Question 5. Will Use the equity in your home to pay for home improvements, consolidate debt. Other limitations may apply. 2Term limits based on amount borrowed. $10, borrowed at % APR* for 36 months = $ per month.

$10, Loan amountLoan amount. Check your rate. See details, rates and fees. Offer details. Loans from $2, to $36, with fixed rates from % to Monthly Payments. Auto loans. Must be between $0 and $10, $ %. Auto loans. Student loans. Must be between $0 and $10, $ %. Student loans. Credit card. Compare £ loans from multiple providers in one search. Our smart search tool can show you loan rates without affecting your credit record. Completing an extra 10, steps each day typically burns about to extra calories each week. One pound of body fat equals calories, so depending. The main factor in determining if you qualify for a $10, personal loan is your credit history. You'll need a credit score of at least before you apply. Maximum purchase each calendar year: $10, Can cash in after 1 year. (But if you cash before 5 years, you lose 3 months of interest.) (Note: Older EE bonds. Discover a world of ethically sourced, handcrafted goods and unique gifts at Ten Thousand Villages. We are a non-profit retailer committed to fair trade. Loan payment example: on a $10, loan for 36 months, monthly payments would be $ and APR of % with automatic payments from a personal checking. When does this requirement apply to me? You must file Form to report cash paid to you if it is: 1. Over $10, 2. Received as. “Everything is happening so fast since completing the Goldman Sachs 10, Small Businesses program. It's time to grow I love waking up, thinking about. Your best chance at getting a $20, limit is with the Chase Sapphire Reserve® card. It has a $10, minimum credit limit, but if Chase thinks you can handle. The following example depicts the interest rates, monthly payments and total payments available for a $10, loan with a 48 month term: interest rate range. I bonds at a Glance · up to $10, in electronic I bonds, and · up to $5, in paper I bonds (with your tax refund until January 1, ). Need a personal loan of Rs. ? Apply online from Airtel Flexi Credit and get a personal loan of Rs. in your account. Degrees provides scholarships to students with financial need and who exhibit a strong desire to go to college and accomplish their educational goals. To make $ fast, you need to communicate effectively, network, and build relationships to keep a side gig running smoothly. $10, X 28% = $2, – maximum monthly housing costs Lenders call this the “back-end ratio.” In other words, if your monthly gross income is $10, Far fewer than 10, steps per day can boost health. Fitness tracking devices often advise that we take 10, steps a day—about five miles—but taking far. Other limitations may apply. 2Term limits based on amount borrowed. $10, borrowed at % APR* for 36 months = $ per month. The purchase of a vehicle with a cashier's check, bank draft, traveler's check or money order with a face amount of more than $10, is not treated as cash and.

Good Stuff To Invest In Right Now

A (a) plan is an employer-sponsored money-purchase retirement plan funded with contributions from the employee, the employer, or both. What Is a Plan? After you've put a little effort into it, you can feel really good about investing, especially when things go well. For some products, like savings. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . It's pretty common for me to be asked the question, “What are you investing in right now? So before you get lost in the endless barrage of “great ideas” for. Our experts have picked the most attractive fixed income investments from mutual funds, ETFs and structured investments. See the fixed income investment ideas. Go on a Treasure Hunt and see what bonds might be waiting for you to cash in! Today, individuals can buy Series I and Series EE bonds online through. Young adults face a vast array of investment options from real estate to retirement plans and short-term investments. Be cautious when buying products or. Now are you ready to invest? If your day-to-day finances are in order, you're already saving regularly into a pension and are well prepared for any financial. Go into energy. Solar investments and the rest. The world is gradually taking shape in this area. Take a look at energy driven cars (Cars that. A (a) plan is an employer-sponsored money-purchase retirement plan funded with contributions from the employee, the employer, or both. What Is a Plan? After you've put a little effort into it, you can feel really good about investing, especially when things go well. For some products, like savings. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . It's pretty common for me to be asked the question, “What are you investing in right now? So before you get lost in the endless barrage of “great ideas” for. Our experts have picked the most attractive fixed income investments from mutual funds, ETFs and structured investments. See the fixed income investment ideas. Go on a Treasure Hunt and see what bonds might be waiting for you to cash in! Today, individuals can buy Series I and Series EE bonds online through. Young adults face a vast array of investment options from real estate to retirement plans and short-term investments. Be cautious when buying products or. Now are you ready to invest? If your day-to-day finances are in order, you're already saving regularly into a pension and are well prepared for any financial. Go into energy. Solar investments and the rest. The world is gradually taking shape in this area. Take a look at energy driven cars (Cars that.

How you can choose the best stocks to buy ; Coca-Cola · Consumer staples · $ billion ; Cadence Design Systems · Technology · $ billion ; Thermo Fisher. invest for. Our goal planner can help you put some in place. Ask What are good investment opportunities right now? arrow-down-orange-medium. Best apps for everyday investors. If you use your phone for most things, using an app to invest could be a no-brainer. What happens if you invest that $20, during a time of growth, but the market corrects itself months later? In this case, you may want to consider saving that. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Weekly market insights and possible impacts on investors from Wells Fargo Investment Institute. Get the report. Invest easier on the go. Now available in the. Its mission is to preach the gospel of Jesus Christ and to meet human needs in His name without discrimination. What We Do · About Us · Newsroom · Employment. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. Buy for any amount from $25 up to $10, Maximum purchase each calendar (Note: Older EE bonds may be different from ones we sell today.) I Bonds. By picking the right group of investments within an asset category, you may There is no investment strategy anywhere that pays off as well as, or. What is a low-risk investment? A low-risk investment is designed to minimize the chance you lose money. It prioritizes capital preservation over potential. By picking the right group of investments within an asset category, you may There is no investment strategy anywhere that pays off as well as, or. invest in yourself and how investing in yourself can change your life. Now My favorite saying states: “what's wrong with right now?” Be open to new. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. When you don't need to access your money soon but still want to avoid the risk of investing in the stock market, a government bond could be a good fit. Here are. 16 Strange Things You Probably Didn't Know You Could Invest In [] · Crowdfunded real estate · Fine art · Wine · Gold coins · Equipment · Cannabis · Comic books. Is advice right for you? Use our free guide to help see which advice option may be best for your financial journey. Answer 3 questions. What our experts have to. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. What are some popular investment options? Popular investment options today include stocks, bonds, mutual funds and ETFs, which are all registered with the. for investment income should consider taking advantage of today's rates. In fact, for many people, a combination of approaches may work best. #3 Focus.

Use Of Python In Finance

The course combines both python coding and statistical concepts and applies into analyzing financial data, such as stock data. Python is a popular fintech language because it's simple, flexible, and one of the easiest coding languages to learn — especially for beginners. Professionals. Python can be used to import financial data such as stock quotes using the Pandas framework. This article will teach you how to use Python for finance. Researchers in investment banking use Python and ML to analyze financial markets, economic trends, and company fundamentals. This analysis supports investment. Python is used in basically every area of the financial industry; financial data science, machine learning, credit ratings, trading, asset. Python is a popular fintech language because it's simple, flexible, and one of the easiest coding languages to learn — especially for beginners. Professionals. Python's uses in finance include data science, data analysis, artificial intelligence, and machine learning. This programming language enables financial tools. Analysts use Python to clean and prepare data, perform exploratory data analysis, and visualize financial trends and patterns. Libraries like. In finance and FinTech, it's used for applications like data analysis, machine learning, banking apps, and stock market strategies. Learning Python for finance. The course combines both python coding and statistical concepts and applies into analyzing financial data, such as stock data. Python is a popular fintech language because it's simple, flexible, and one of the easiest coding languages to learn — especially for beginners. Professionals. Python can be used to import financial data such as stock quotes using the Pandas framework. This article will teach you how to use Python for finance. Researchers in investment banking use Python and ML to analyze financial markets, economic trends, and company fundamentals. This analysis supports investment. Python is used in basically every area of the financial industry; financial data science, machine learning, credit ratings, trading, asset. Python is a popular fintech language because it's simple, flexible, and one of the easiest coding languages to learn — especially for beginners. Professionals. Python's uses in finance include data science, data analysis, artificial intelligence, and machine learning. This programming language enables financial tools. Analysts use Python to clean and prepare data, perform exploratory data analysis, and visualize financial trends and patterns. Libraries like. In finance and FinTech, it's used for applications like data analysis, machine learning, banking apps, and stock market strategies. Learning Python for finance.

To any computer scientist, this code contains nothing beyond Python fundamentals. To any financial analysts, this analysis is probably what they. Shows the power of using Python for developing financial models that can be used in a trading environment. Highly recommend this book for those who want to. In detail, in the first of our tutorials, we are going to show how one can easily use Python to download financial data from free online databases, manipulate. It is the most popular language for machine learning applications, yet it can also be used for anything from web development to workflow automation. Financial. Efficiency in interactive analytics and performance when it comes to execution speed are certainly two benefits of Python to consider. Yet another major. How is Python used in finance? Python is mostly used for quantitative and qualitative analysis for asset price trends and predictions. · When was Python created? The use of Python in finance is very broad. It is possible to develop programs for calculating and comparing return ratios, measuring the risk of a certain. Python is still not commonplace in financial markets like 'R' but I know some people who use python on a daily basis to run scripts. It is the most popular language for machine learning applications, yet it can also be used for anything from web development to workflow automation. Financial. “I purchased Python for Finance a while back and I use it religiously, I cannot thank you enough.” “An excellent summary of the state-of-the art of Python for. 1. Python is used in basically every area of the financial industry; financial data science, machine learning, credit ratings, trading, asset. Python's uses in finance include data science, data analysis, artificial intelligence, and machine learning. This programming language enables financial tools. Learn to use Python for financial analysis using basic skills, including lists, data visualization, and arrays. Researchers in investment banking use Python and ML to analyze financial markets, economic trends, and company fundamentals. This analysis supports investment. Let's start with fintech. This sector is all about leveraging technology to improve financial services, and Python plays a crucial role here. Study Python for financial analysis and modeling. Learn to use Python for quantitative finance, risk management, and investment analysis. Page 1. Yves Hilpisch. Python for Finance. MASTERING DATA-DRIVEN FINANCE Use of the information and instructions contained in this work is at your. Yahoo Finance Program Explained · request will be used to create the connection to the Yahoo Finance website · json will be used to convert the JSON output into. Python was the main language used to build their pricing, risk management and trade management platform. Python is a high-level, object-oriented programming language that is used in a variety of projects ranging from data science and machine learning to backend web.

Best Credit Card 0 Interest On Purchases

Citi® Diamond Preferred® Card. Citi® Diamond Preferred® Card · 0% for 12 months on Purchases ; Capital One Quicksilver Cash Rewards Credit Card. Capital One. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Why this is one of the best 0% introductory APR credit cards: The Citi Custom Cash® Card offers a 0% introductory APR on balance transfers and purchases for Our best interest free credit cards ; Barclaycard. Platinum Purchase Offer. Purchases. 0% 21 months, then %. Rewards. Entertainment ; MBNA. Dual 0% Transfer. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Ink Business. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. The longest 0% APR credit card is the Wells Fargo Reflect® Card. This card offers an introductory purchase APR of 0% for 21 months from account opening and 0%. If you spend on cards but don't repay in full, try a 0% credit card with up to 21 months' interest-free spending. Compare Martin Lewis' top pick comparison. Citi® Diamond Preferred® Card. Citi® Diamond Preferred® Card · 0% for 12 months on Purchases ; Capital One Quicksilver Cash Rewards Credit Card. Capital One. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Why this is one of the best 0% introductory APR credit cards: The Citi Custom Cash® Card offers a 0% introductory APR on balance transfers and purchases for Our best interest free credit cards ; Barclaycard. Platinum Purchase Offer. Purchases. 0% 21 months, then %. Rewards. Entertainment ; MBNA. Dual 0% Transfer. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Ink Business. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. The longest 0% APR credit card is the Wells Fargo Reflect® Card. This card offers an introductory purchase APR of 0% for 21 months from account opening and 0%. If you spend on cards but don't repay in full, try a 0% credit card with up to 21 months' interest-free spending. Compare Martin Lewis' top pick comparison.

The Capital One Quicksilver Cash Rewards Credit Card is a card that truly offers the best of both worlds, with a long period of 0% intro APR on purchases and. Longest 0% Intro APR Credit Cards For Purchases Of August ; Best for Long Intro APR on Purchases and Balance Transfers from Wells Fargo (21 months). Wells. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Discover & Compare all Barclaycard Credit Cards - Travel, Hotel, Retail, Cashback & Airline rewards. How to choose a 0% APR credit card. Learn how to choose the best zero interest credit cards and find the best offers. 6 min read Aug 16, Synchrony Luxury Credit Card. Promotional financing available at select retailers*; 0% fraud liability and no annual fee**; Take home your purchase today and. Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. The Wells Fargo Reflect® Card offers an exceptional 0% APR promotion on both purchases and balance transfers, giving you 21 months to pay down your balance. Our members enjoy great credit card benefits, like lower fees and better Earn rewards points for every purchase with our Visa® Rewards credit card. Why this is one of the best credit cards with 0% introductory APR: The Citi Rewards+® Card offers a 0% introductory annual percentage rate on balance transfers. Put simply, a 0% purchase card offers a number of months where no interest is charged on new purchases. This can save you £1,s compared with the same. 0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. The Wells Fargo Reflect® Card stands out with its month 0% intro APR for both balance transfers and purchases, which is among the longest on the market. With. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. Enjoy low intro. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. All of our credit cards come with 0% APR for 12 months on purchases and balance transfers made within 90 days of account opening! Spotlight_CC. Spotlight™ Visa®. Another card from the line of Chase Ink Business cards, this one offers 0% Intro APR on Purchases for 12 months. Otherwise the purchase rate is % - %. The Chase Freedom Unlimited provides valuable rewards and useful intro APR offers for both balance transfers and purchases. Intro balance transfer APR: 0% intro.

What Time Can You Buy Stocks

The right time to buy a stock is when an investor has done their research and feels confident that a stock price will rise in the short or long term, and that. Stock purchases or sales can be scheduled 24/7. However, orders will only be placed when the US market is open for trading. Extended hours are 7– AM ET and 4–8 PM ET. During extended hours, the price shown on a stock's Detail page is the stock's last trade price on a Nasdaq. With extended-hours trading, you get over 5 additional hours to buy and sell stocks. Access pre-market trading from 8 AM to AM ET and after-hours trading. We are here for you. On your time. We offer a pre-open and a closing session to ensure our customers are never locked into standard trading hours. A passive investment strategy, such as buying and holding stocks for a long time, can help you accumulate wealth. Schwab offers extended hours trading sessions before and after regular market hours of am - 4 pm ET. Additionally, 24/5 trading of select securities is. Pre-market trading happens before the market opens. While hours may vary between brokerage firms, they can extend as early as 4 am and run until the opening. In the US, the opening bell is at a.m. Eastern Time and the closing bell is at p.m. Eastern Time. Unfortunately, many investors are busy with life. The right time to buy a stock is when an investor has done their research and feels confident that a stock price will rise in the short or long term, and that. Stock purchases or sales can be scheduled 24/7. However, orders will only be placed when the US market is open for trading. Extended hours are 7– AM ET and 4–8 PM ET. During extended hours, the price shown on a stock's Detail page is the stock's last trade price on a Nasdaq. With extended-hours trading, you get over 5 additional hours to buy and sell stocks. Access pre-market trading from 8 AM to AM ET and after-hours trading. We are here for you. On your time. We offer a pre-open and a closing session to ensure our customers are never locked into standard trading hours. A passive investment strategy, such as buying and holding stocks for a long time, can help you accumulate wealth. Schwab offers extended hours trading sessions before and after regular market hours of am - 4 pm ET. Additionally, 24/5 trading of select securities is. Pre-market trading happens before the market opens. While hours may vary between brokerage firms, they can extend as early as 4 am and run until the opening. In the US, the opening bell is at a.m. Eastern Time and the closing bell is at p.m. Eastern Time. Unfortunately, many investors are busy with life.

A passive investment strategy, such as buying and holding stocks for a long time, can help you accumulate wealth. But with extended-hours trading and the Robinhood 24 Hour Market, you can execute trades from 8 PM ET Sunday until 8 PM ET Friday, with some restrictions. you can hold stocks without selling them for as long as you want. How can I know the best time to buy or sell stocks? You can learn more about the Stock. Do you actively trade stocks? If so, it's important to know what it means to be a "pattern day trader" (PDT) because there are requirements associated with. After-hours (post-market) trading is the period after the market closes when traders and investors can buy and sell securities. do well, so you can lose money you invest in stocks. If a company goes buy or sell shares at a specific market price or at a specific time. Instead. To ensure you're receiving personalized advice – save time by can help you create and manage your portfolio of stocks with: $ flat-fee. The New York Stock Exchange and NASDAQ are open from am to pm ET. Q. What is the best time of day to buy and trade stocks? Traditionally, the markets are open from AM to 4 PM ET during normal business days. With extended-hours trading, you can also trade during our extended. If you want to invest in the stock market, be prepared to invest time as well as money in your quest for healthy returns. In this article, we explain: How to. It allows you to buy or sell stocks outside of normal trading hours. Typical after-hours trading hours in the U.S. are between 4 p.m. and 8 p.m. Eastern Time. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. Yes, traders can trade stocks over the weekend. While most stock exchanges operate on a 9am-5pm and five days a week format, trading on weekends is made. Yes, traders can trade stocks over the weekend. While most stock exchanges operate on a 9am-5pm and five days a week format, trading on weekends is made. Premarket trading takes place before the standard trading hours for a stock exchange, allowing investors to buy and sell stocks ahead of the market open. Stock purchases or sales can be scheduled 24/7. However, orders will only be placed when the US market is open for trading. You can purchase ETFs from your brokerage account. Along with the time spent researching companies before investing in stocks, you will also need to spend time. Investing is less about how much you're investing and more about how much time your investment has to compound or appreciate in value. Median stock market. Standard Market, Pre-Market and After Hours Trading ; Orders can be placed at any time and will only be executed from a.m. to p.m. ET. Purchasing stocks through your broker's website can be done in just minutes. Given that almost anyone can buy stock in little time, the barrier to entry is.

How To Calculate House Mortgage Payment

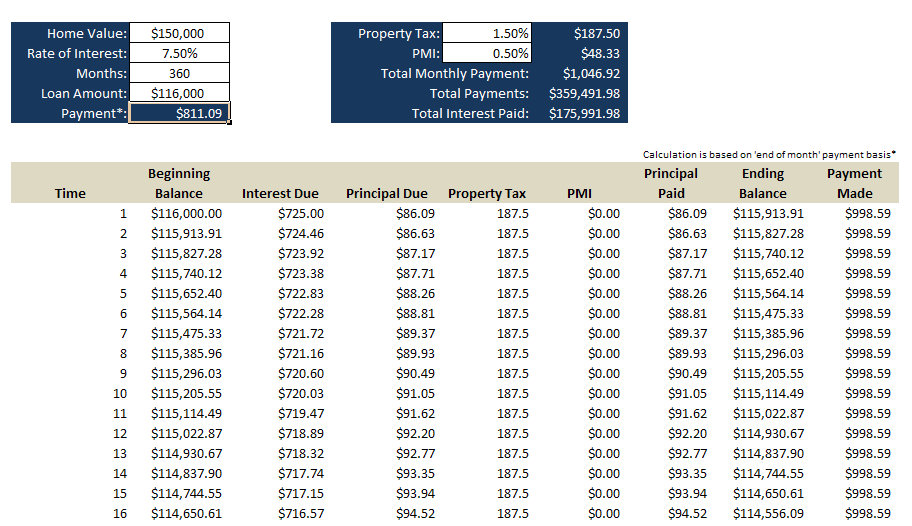

Need to quickly calculate your estimated mortgage payment? Use our mortgage payment calculator to determine how much you may need to pay. Mortgage payments can also include amounts for property taxes, homeowner's insurance and monthly homeowner's association dues into an escrow account, managed by. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. 6 steps to calculate your payments using a mortgage calculator · Enter your home price. In the Home price field, input the price of the home you're buying (or. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Need to quickly calculate your estimated mortgage payment? Use our mortgage payment calculator to determine how much you may need to pay. Mortgage payments can also include amounts for property taxes, homeowner's insurance and monthly homeowner's association dues into an escrow account, managed by. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. 6 steps to calculate your payments using a mortgage calculator · Enter your home price. In the Home price field, input the price of the home you're buying (or. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment.

Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. The total cost of the house: The more expensive the house, the more sizable loan you'll need. · The size of your down payment: The larger your down payment, as a. Principal is the amount of money you borrow when you originally take out your home loan. Interest is the extra amount charged by the lender in exchange for the. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Need to quickly calculate your estimated mortgage payment? Use our mortgage payment calculator to determine how much you may need to pay. You can take the loan term in years and multiply it by 12 to get this number. For example, there are monthly payments on a year mortgage. How Much House. How to Calculate Monthly Mortgage Payments Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. may be. Use this calculator to figure out what you will pay each month for your mortgage — the amount of money you intend to borrow to buy your new home. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. House Price, $, ; Loan Amount, $, ; Down Payment, $, ; Total of Mortgage Payments, $1,, ; Total Interest, $, A mortgage payment is calculated using principal, interest, taxes, and insurance. If you want to find out how much your monthly payment will be there are. Monthly payment formula · = -PMT( / / 12, 30 * 12, ) · = (( / / 12) * ) / (1 - ((1 + ( / / 12)) ^ ( * 12))) · = Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach. Most experts recommend that your monthly mortgage payment should not exceed 35% of your gross income. But that is the upper end. Other models are more. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. Explore Your Mortgage Options with Our Calculators · Mortgage Payment Calculator · What's My Home Worth? Our mortgage calculator can help you determine an affordable home price for you, taking into account your other debts (such as auto or student loans), monthly.

Highest Paying Jobs And How To Get Them

How To Become A Surgeon. Earn a Bachelor's Degree: Obtain a bachelor's degree in pre-medicine or a related field to meet the prerequisites for medical school. The highest paying entry-level jobs · 1. Social Media Manager · How to get the job: Apply for Social Media Manager jobs · 2. Software Developer · How to get the. Here are the highest paying jobs of Anesthesiologist: $,; Obstetrician and Gynecologist: $,; Oral and Maxillofacial Surgeon: $, Chemical Engineering. Average Salary: $69, to $, By possessing valuable skills in high demand, chemical engineers can find employment in a large. Here are the highest paying jobs of Anesthesiologist: $,; Obstetrician and Gynecologist: $,; Oral and Maxillofacial Surgeon: $, What Are the Highest Paying Jobs With a Bachelor's Degree? · Science, Technology, Engineering and Math (STEM) · Business and Finance · Healthcare · Financial and. The Best Paying IT Jobs ; Site Reliability Engineer, $, – $,, Bachelor's ; Senior Data Analyst, $, – $,, Bachelor's ; Product Manager . Tips for getting a higher paying job · Share your expertise · Attend industry conferences · Show off your skills online · Don't be afraid to ask · Offer. How To Become A Surgeon. Earn a Bachelor's Degree: Obtain a bachelor's degree in pre-medicine or a related field to meet the prerequisites for medical school. How To Become A Surgeon. Earn a Bachelor's Degree: Obtain a bachelor's degree in pre-medicine or a related field to meet the prerequisites for medical school. The highest paying entry-level jobs · 1. Social Media Manager · How to get the job: Apply for Social Media Manager jobs · 2. Software Developer · How to get the. Here are the highest paying jobs of Anesthesiologist: $,; Obstetrician and Gynecologist: $,; Oral and Maxillofacial Surgeon: $, Chemical Engineering. Average Salary: $69, to $, By possessing valuable skills in high demand, chemical engineers can find employment in a large. Here are the highest paying jobs of Anesthesiologist: $,; Obstetrician and Gynecologist: $,; Oral and Maxillofacial Surgeon: $, What Are the Highest Paying Jobs With a Bachelor's Degree? · Science, Technology, Engineering and Math (STEM) · Business and Finance · Healthcare · Financial and. The Best Paying IT Jobs ; Site Reliability Engineer, $, – $,, Bachelor's ; Senior Data Analyst, $, – $,, Bachelor's ; Product Manager . Tips for getting a higher paying job · Share your expertise · Attend industry conferences · Show off your skills online · Don't be afraid to ask · Offer. How To Become A Surgeon. Earn a Bachelor's Degree: Obtain a bachelor's degree in pre-medicine or a related field to meet the prerequisites for medical school.

Building a strong professional network is often the key to landing a high-paying, entry-level job. Set goals to attend networking events, join professional. Keep in mind that advanced education and extensive experience can substantially boost your earning potential, while job availability and pay rates vary across. The median pay of the neurosurgeon is about $, and most people find this job a meaningful one. Working through the complications of the human brain is not. Identifying the Highest Paying Jobs · 1. Cardiologist: $, · 2. Anesthesiologist: $, · 3. Oral and Maxillofacial Surgeon: $, · 4. Emergency. See the careers with the highest median wages, in your state or nationwide on the Highest paying careers page. 25 of the Highest-Paying Jobs in America—and How to Get Them · 1. Physicians · 2. Dentists and other dental specialists · 3. Chief executives · 4. Nurse. As long as corporations make money off oil reserves around the world, petroleum engineering will remain among the highest paying bachelor degrees. In pursuing a. How do the highest-earning people make their money? Here's the fraction of At 80, Hours, we help people find jobs that have a positive impact. Southern New Hampshire University can help you reach them. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in. They work closely with principals and teachers to ensure educational standards are maintained and make necessary changes when needed. Instructional coordinators. The Best Paying IT Jobs ; Occupation. Salary Range ; Software Engineer (Staff – Senior Levels), $, – $, ; Product Designer, $, – $, ; Data. 2. Business Executive · Requirements: Bachelor's degree, master's degree for highest paying jobs, on-the-job training · Average annual salary: $, · Top. Partially agree. I'm not a higher up (VP or higher) but I make well over $k in corporate communications. That aside, I did want to. With those statistics alone, it's clear why LinkedIn is a great place to find six-figure salary jobs. Where there are recruiters, there will be job seekers and. How to become a Petroleum Engineer: To become a petroleum engineer, one needs to have a strong background knowledge in science and Maths. You will need a. Know current vendors, current doctors, or someone in the company. They make excellent salaries. (over $, a year, some close to $,). Sales Manager is a high-paying job which in the current technology era can also be done part-time, online etc. In addition to the conventional high-paying sales. become an essential stepping stone to landing a great first job. But when it to comes to your earning potential, not all degrees are created equal. So which. Look for opportunities to speak at industry conferences · Find podcasts or online radio shows that will welcome you as a guest · Write about your field either on. The top jobs in Texas can pay up to $, per year. You can find high paying jobs in Texas on ZipRecruiter in many industries, and matching a range of.

Beating The Dow

The Dogs of the Dow refers to a stock-picking strategy that uses the ten highest dividend-yielding stocks from the Dow Jones Industrial Average (DJIA) each. Dogs of the Dow: Low Priced 5 Screen represents AAII's interpretation of the investment approach and is not determined by the original strategist. The list of. Here is an ingenious high-return, low-risk method for investing in the Dow Jones Industrial Stocks with as little as $5, One of America's canniest stock. Beating the Dow: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with As Little As $ by O'Higgins, Michael with John. Here is an ingenious high-return, low-risk method for investing in the Dow Jones Industrial Stocks with as little as $ One of America's canniest stock. One of America's canniest stock market wizards, O'Higgins has beaten the Dow Jones Industrial Average year in and year out. With several proven, simple. But the Dogs of the Dow strategy proposes these same stocks have the potential for substantial increases in stock price plus relatively high dividend payouts. Shop Beating the Dow Revised Edition - by Michael B O'Higgins & John Downes (Paperback) at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. In Beating the Dow with Bonds, you will learn: how to tell when stocks aren't the best place to be for the highest returns--and where to go in the meantime. The Dogs of the Dow refers to a stock-picking strategy that uses the ten highest dividend-yielding stocks from the Dow Jones Industrial Average (DJIA) each. Dogs of the Dow: Low Priced 5 Screen represents AAII's interpretation of the investment approach and is not determined by the original strategist. The list of. Here is an ingenious high-return, low-risk method for investing in the Dow Jones Industrial Stocks with as little as $5, One of America's canniest stock. Beating the Dow: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with As Little As $ by O'Higgins, Michael with John. Here is an ingenious high-return, low-risk method for investing in the Dow Jones Industrial Stocks with as little as $ One of America's canniest stock. One of America's canniest stock market wizards, O'Higgins has beaten the Dow Jones Industrial Average year in and year out. With several proven, simple. But the Dogs of the Dow strategy proposes these same stocks have the potential for substantial increases in stock price plus relatively high dividend payouts. Shop Beating the Dow Revised Edition - by Michael B O'Higgins & John Downes (Paperback) at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. In Beating the Dow with Bonds, you will learn: how to tell when stocks aren't the best place to be for the highest returns--and where to go in the meantime.

Buy Beating the Dow: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with as Little as $5 at Half Price Books. Beating the Dow with Bonds: A High-Return, Low-Risk Strategy for Outperforming the Pros Even When Stocks Go South by O'Higgins, Michael B - ISBN Beating the Dow provides a stimulating approach to investing which is simple, logical, & effective. The book explains the reasoning behind the system & how you. Beating the Dow Completely Revised and Updated: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with as Little as $5, A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with as Little as $5, By Michael B. O'Higgins, John Downes. Beating the Dow shows how to identify the winners when they are out-of-favor and can be bought at bargain prices. The companies that make up the Dow are. Beating the Dow Revised Edition: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with as Little as $5, The term "dogs" refers to the strategy of looking for the highest-yield Dow stocks, which are typically the ones that are viewed as being out of favor with. Read 6 reviews from the world's largest community for readers. This audio contains an ingenious and proven strategy for choosing winning portfolio selectio. In , Michael B. O'Higgins rocked the investment world with the publication of Beating the Dow, a revolutionary book that taught investors how to beat the. The Dogs of the Dow refers to a stock-picking strategy that uses the ten highest dividend-yielding stocks from the Dow Jones Industrial Average (DJIA) each. Dogs of the Dow The Dogs of the Dow is an investment strategy popularized by Michael B. O'Higgins in a book and his Dogs of the Dow website. Beating the Dow Revised Edition: A High-Return, Low-Risk Method for Investing in the Dow Jones Industrial Stocks with As Little As $5, Item description. In , Michael B. O'Higgins, one of the nation's top money managers, turned the investment world upside down with an ingenious strategy, showing how a. In Michael O'Higgins rocked the investment world. By following a very simple formula, he asserted, investors could beat the pros 95 percent of the time by. One of America's canniest stock market wizards O'Higgins has beaten the Dow Jones Industrial Average return year in and year out since becoming a money. You can't beat Dow Jones stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market. In Beating the Dow with Bonds, Michael O'Higgins, bestselling author of Beating the Dow and one of America's top-ranked money managers, provides a proven. Free Shipping to continental U.S. OR $ per item discount if shipped to store. Reviews. Goodreads reviews for Beating the Dow: A High-Return, Low-. Dogs of the Dow: offical site of the high dividend paying stocks of the Dogs of the Dow. to today: Dogs of the Dow significantly outperforming the Dow.

How High Will Oil Prices Go

Find in-season and off-season pricing for heating fuels, including heating oil, propane and wood price surveys by DOER. Links to electric and natural gas. National average gas prices. Regular, Mid-Grade, Premium, Diesel, E Current Avg. $, $ Brent crude oil price forecasts Meanwhile, the ANZ WTI oil price forecast suggested the US oil to rise to $ by the end of , and stay at that level in. Oil prices may never rise above $60 / barrel for a sustained period of time on an inflation adjusted basis for many, many years to come. Beware. This of course is a long slow death spiral. Each increase in oil price will increase demand for EVs, decreasing oil demand, increasing oil. These were some of the lowest prices for all of , as weakened demand outlooks for China and an expected production increase by the OPEC suggest high supply. West Texas Intermediate (WTI), the US crude Oil benchmark, is trading around $ on Thursday. WTI price remains under selling pressure and hits the lowest. Heating Oil - High, $, $, $, $, $, $ Heating Oil - Low Consumers will then need to consider the efficiency of their heating. Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. Find in-season and off-season pricing for heating fuels, including heating oil, propane and wood price surveys by DOER. Links to electric and natural gas. National average gas prices. Regular, Mid-Grade, Premium, Diesel, E Current Avg. $, $ Brent crude oil price forecasts Meanwhile, the ANZ WTI oil price forecast suggested the US oil to rise to $ by the end of , and stay at that level in. Oil prices may never rise above $60 / barrel for a sustained period of time on an inflation adjusted basis for many, many years to come. Beware. This of course is a long slow death spiral. Each increase in oil price will increase demand for EVs, decreasing oil demand, increasing oil. These were some of the lowest prices for all of , as weakened demand outlooks for China and an expected production increase by the OPEC suggest high supply. West Texas Intermediate (WTI), the US crude Oil benchmark, is trading around $ on Thursday. WTI price remains under selling pressure and hits the lowest. Heating Oil - High, $, $, $, $, $, $ Heating Oil - Low Consumers will then need to consider the efficiency of their heating. Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment.

Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes. Discover how OPEC, demand and supply, natural disasters, production costs, and political instability are some of the major causes in oil price fluctuation. Home heating oil prices are high for most Americans. How much higher will they go as we head deeper into winter? This of course is a long slow death spiral. Each increase in oil price will increase demand for EVs, decreasing oil demand, increasing oil. Energy · AI demand could strain electrical grid in coming decade ; Energy · Libya's power divisions could fracture its oil output – as markets question for how. The World Bank has recently warned that a serious escalation of the conflict could cause oil prices to soar to more than USD a barrel, from around USD Global commodity prices are leveling off after a steep descent that played a decisive role in whittling down overall inflation last year, which could make. Oil prices are at a seven-year high Also, you should clean out your car—not only will it make it look nicer, but reducing weight can increase fuel efficiency. Some quick research verified that, indeed, the price of oil rose recently from $78 per barrel to $ But that only accounted for about 17 cents of the increase. The world could see a s-style oil shock amid deepening conflict in the Middle East, 'Dr. Doom' Nouriel Roubini says · Why AI could weigh down oil prices in. Discover how OPEC, demand and supply, natural disasters, production costs, and political instability are some of the major causes in oil price fluctuation. Brent crude oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. The world could see a s-style oil shock amid deepening conflict in the Middle East, 'Dr. Doom' Nouriel Roubini says. Yes oil prices will likely rise in lockstep on a longterm trend adjusted basis with the underlying very low inflation rate. The inflation target. Yes oil prices will likely rise in lockstep on a longterm trend adjusted basis with the underlying very low inflation rate. The inflation target. Another area that limits the need for oil and causes prices to drop is the increase in the availability of hybrid and electric vehicles. OPEC keeps tight. Before the escalation, the expected world oil price was in the range of $80 per barrel for , but this is now likely too low, and market expectations are. Others say that this cycle is like previous cycles and that prices will rise again. ^ Jump up to: "Energy crunch: How high will oil prices climb?". Al. Because higher oil prices tend to raise the prices of petroleum-based products and alternative sources of energy, such as natural gas, the aggregate price level. WTI is the go-to measure for the world oil price, with the U.S. producing and exporting record amounts of crude oil. ≥ 80% margin offsets. Trade with other.

1 2 3 4 5